Media Update: Video Consumption Up By 27%, NFL Conference Championship Audience Growth, and Tech Earnings

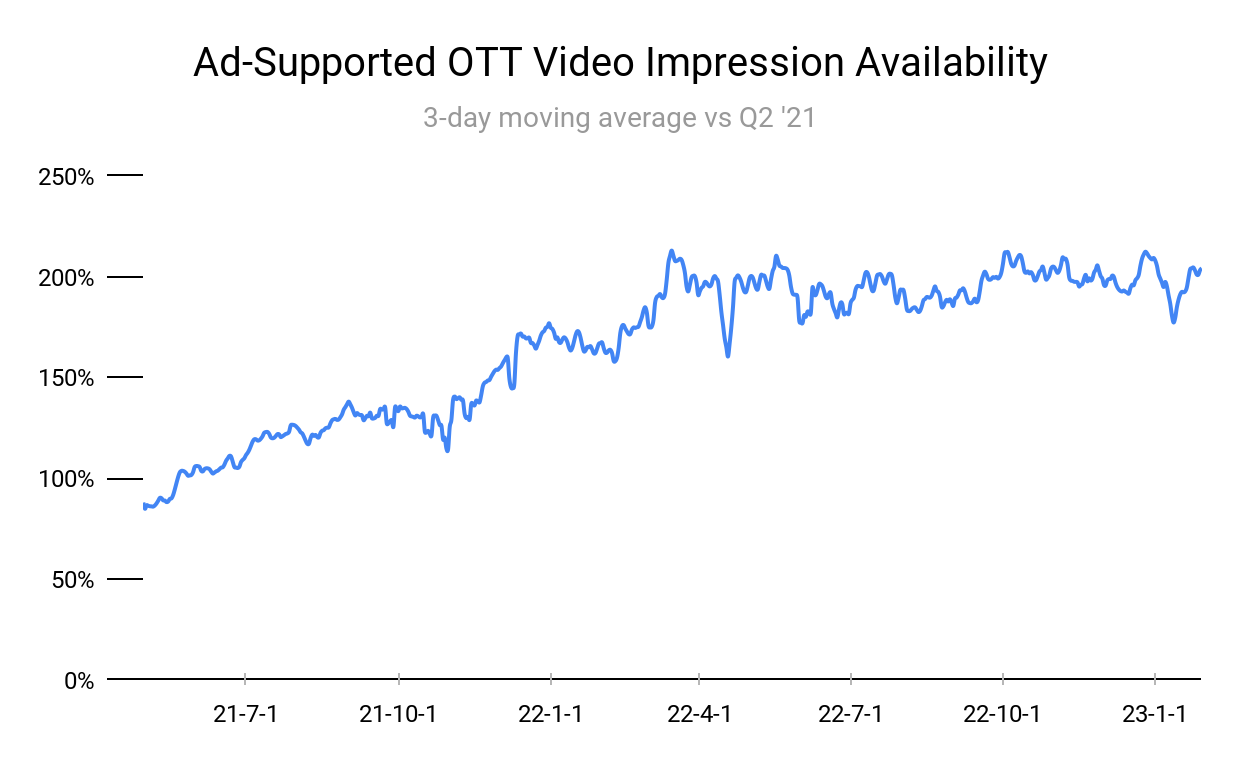

Ad-supported video supply has bounced back from its early January dip, but has not shown very meaningful growth over the past three quarters.

Industry Notes (Video)

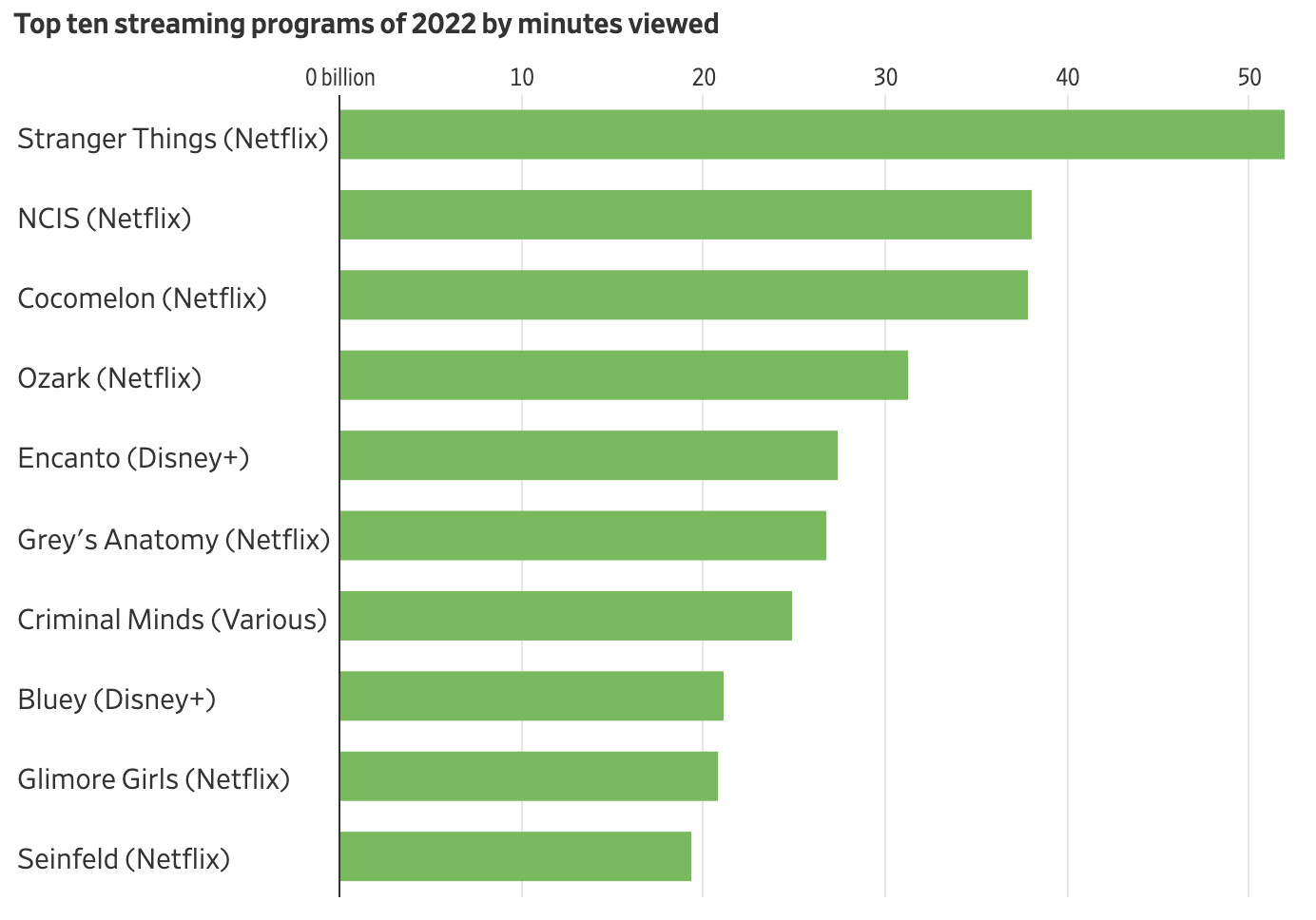

1. Although subscription growth slowed for many streamers last year, viewers showed no sign of slowing down their consumption. U.S. viewers watched approximately 19.4 million years of content in 2022(!), setting an all-time record and exceeding the prior year’s record by 27%. Aside from the usual narrative about the growth of the streaming industry, there are couple interesting nuggets from this report:

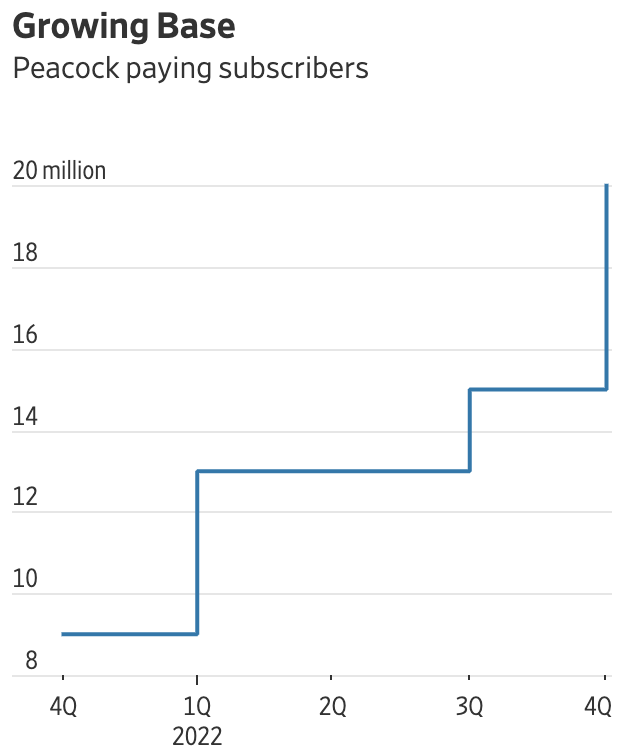

2. After facing a concerning slowdown in its subscriber growth early last year, Peacock kicked it into high gear in Q4 and acquired 5 million subs, its largest quarterly gain since launch in 2020. For the year, the streamer’s base more than doubled, increasing from 9 to 20 million. Peacock also earned a spot on the Nielsen Gauge in December, reaching 1% of total TV usage as a result of FIFA World Cup and Sunday Night Football viewership. However, these achievements came at a cost – a loss of nearly one billion dollars, its worst quarter to date.

With losses mounting, the streamer is taking several steps to capitalize on its subscription momentum in the new year. Peacock has begun sunsetting its free tier, preventing new users from accessing the platform without a subscription (current users still have access to free content, for now). It is unclear how this will affect the bottom line, particularly with regard to its advertising revenue. Estimates from last year put the free tier user base at around ~15 million – that’s a lot of viewers that Peacock won’t be able to serve ads to when they fully pull the plug. This move is part of a broader strategy to increase subscription revenue; Peacock recently ended its deal with Cox to give internet customers free access to the premium tier, and plans to do the same with Xfinity soon.

By investing heavily in content, removing its free tier, and restricting access, Peacock hopes to become a serious competitor in premium AVOD and SVOD space. With annual losses projected to peak at $3 billion in 2023, it will need to convert a significant number of these customers to get anywhere near profitability in the next few years. | WSJ

3. Peacock is not the only streaming platform from a legacy media company that is rapidly iterating in search of sustainable profitability – in an effort to reduce its cost base and hopefully produce some revenue synergies, Paramount looks likely to merge Paramount+ and Showtime into a single streaming service, while rebranding the Showtime cable channel as ‘Paramount+ with Showtime’ and stocking it with content from the Paramount+ streaming service. While the new moniker is not the most euphonious, it at least communicates to consumers what it is – Showtime shows like Billions and Yellowjackets, plus content from Paramount+ like Tulsa King, 1883, and Mayor of Kingstown.

Paramount is navigating a number of tricky constraints simultaneously. Its streaming business is losing about $2 billion per year, while its linear networks, which cross-subsidize the streaming business, are experiencing substantial revenue declines as a result of cord cutting. So reducing its overall costs basis is imperative, and running one streaming service is cheaper than running two; but Showtime subscribers currently receive Showtime Anytime, the streaming app, for free. So Paramount will need to mollify its cable operator partners – who are the conduit to the profitable part of Paramount’s business – and is likely to do so by offering cable subscribers Paramount+ for free. Giving away a product for free is not the obvious way to boost revenue, but Paramount is constrained similarly to HBO, which gave HBO Max free to cable subscribers so as to avoid channel conflict with its cable operator partners.

Some thoughtful analysts are bearish on Paramount’s prospects, whatever moves it makes in the present moment; the estimable Ben Thompson said recently, “Paramount+ is irrational … It makes no sense, it never made sense … so you can prop up a streaming service that’s not going to be around in two years, is insane behavior.” Ouch. We’ve discussed at length over the past couple of years that numerous streaming services losing billions of dollars each is not a sustainable equilibrium, and that we should expect to see a wave of bundling, more ads, and consolidation as the industry rationalizes its structure. Paramount may be a prime candidate for a coming consolidation wave. | WSJ, The Information

4. Quite the opposite of Peacock, Warner Bros. Discovery is embracing free ad-supported television. WBD is jumping into the FAST game before the launch of its own free tier on Max, inking deals with Roku and Fox’s Tubi to bring a trove of TV and movie titles to the platforms. The content, which includes shows that were canceled during the company’s merger, will be available on-demand and via dedicated FAST channels. For WBD, the decision to monetize library content after suffering several quarters of damaging losses is a no-brainer – it will generate immediate revenue and introduce hit content (such as Westworld) to a new audience, potentially luring new subscribers to its own service. Furthermore, distributing content to FAST services will help alleviate some pain in packaging WBD’s diverse and expansive catalog into a singular premium SVOD service. | Fierce Video

All categories of linear viewership are down YoY, with general entertainment (where there is the strongest competition from streaming platforms) suffering the largest decline.

Industry Notes

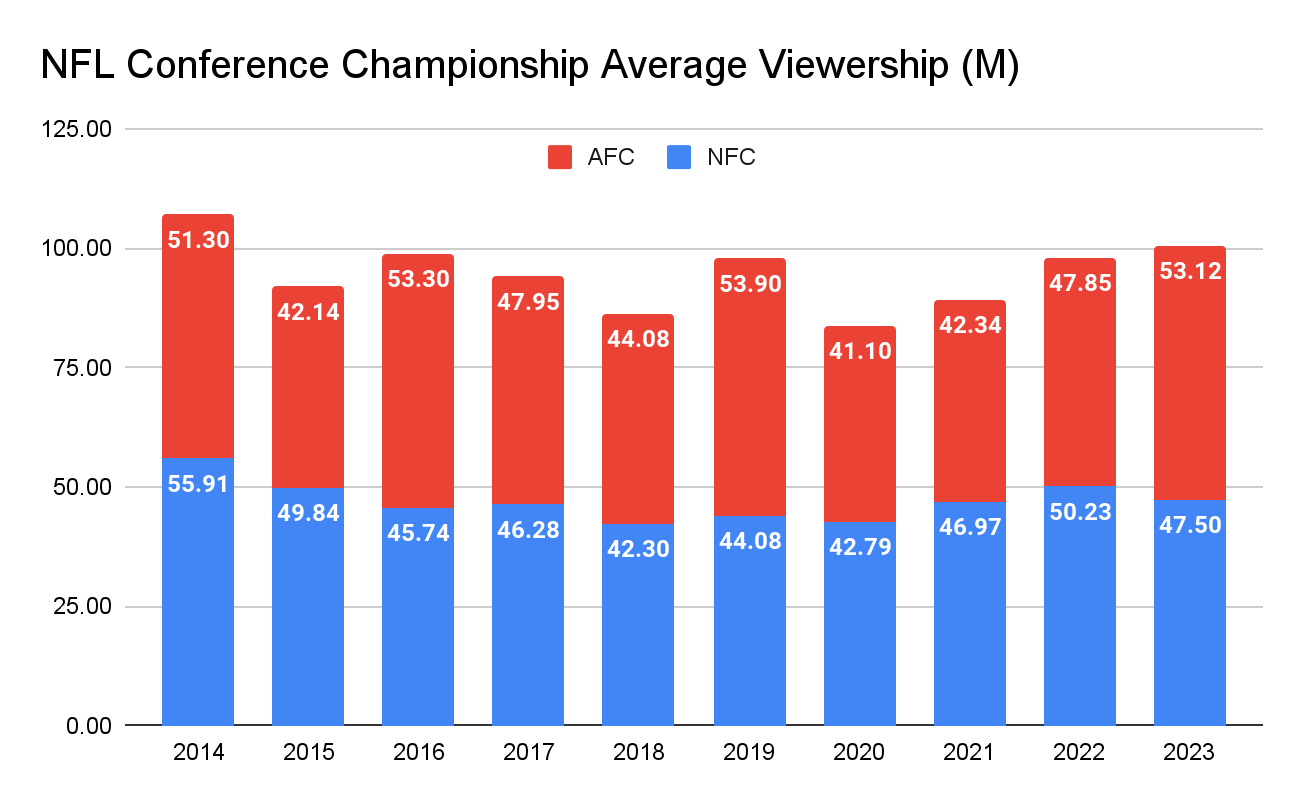

1. NFL playoff viewership rose sharply for conference championship weekend. The exciting Sunday night matchup between the Bengals and Chiefs drew the largest conference championship audience since 2019, averaging 53 million viewers. Earlier in the day, Eagles-49ers viewership came in a mere 5% lower than last year, despite a dominant performance by the birds in which they conceded only one touchdown. Notably, combined viewership for the weekend reached the highest level since 2014, capping off a historic season for the NFL. | SMW

2. Both Charter and Comcast hemorrhaged subscribers in the fourth quarter, losing 145,000 and 440,000 respectively. Although it could be said that some of Comcast’s losses were offset by the 5 million subscriber gain at Peacock, it is hard to ignore that the company’s core business is in irreversible decline. In the past two years, its residential video customer base has fallen from nearly 19 million to around 15.5 million, an 18% decrease. As an integrated entity, the subscriber loss means not only reduced revenue for the cable operation, but also reduced affiliate fees for the NBCU linear networks that are currently providing subsidies to the loss-making streaming operation. | WSJ

1. It’s a big week of earnings announcements for the major digital platforms, and Snap kicked things off on Tuesday with pretty dire results, with Q4 revenue flat to the year prior and guidance that current quarter revenue may show a 10% drop. The revenue growth figure was the lowest for the company since going public almost six years ago. Snap has been one of the platforms most heavily impacted by ATT, the privacy policy Apple rolled out in April 2021 that took away a key ingredient for targeting and attribution. Notably, Snap CEO Evan Spiegel was an early supporter of ATT (in sharp contrast to Mark Zuckerberg, another tech CEO whose business was heavily impacted); and, to his credit, he’s stuck to his guns even as the destruction to his business has become clear.

On the positive side, Snap’s DAU’s were up 17%, suggesting the problem lies squarely with its advertising business, not with its core product’s ability to engage users. As the company’s CFO noted, “We are demand constrained and not supply constrained at the moment.” | WSJ, AdExchanger

2. Snap was followed a day later by Meta, whose stock soared by bettering pessimistic expectations and providing encouraging forward guidance.

While the share price rise was dramatic, Meta is not (yet) back to its growth glory days – Q4 revenue declined by 4.5% YoY, the same pace of decline as the prior quarter, and income fell by almost half (much of the cost increase was in R&D, related to Metaverse development as well as investments in artificial intelligence aimed at rebuilding its ad targeting capabilities post-ATT).

In terms of underlying fundamentals that matter to us marketers, the picture is quite positive – Facebook’s global DAU’s reached 2 billion in Q1, up from 1.98 billion three months ago; in the U.S. & Canada, DAU’s increased from 197 million to 199 million. As supply has increased, continued soft demand from advertisers has lowered clearing ad prices: the company said its average ad price fell 22% YoY.

As we all attempt to read the tea leaves for what the near future holds, Facebook is of course a very important indicator for the broader digital economy; the company guided that Q1 revenue would be near $28.5 billion, which would mark a return to revenue growth following three consecutive quarters of decline. | WSJ

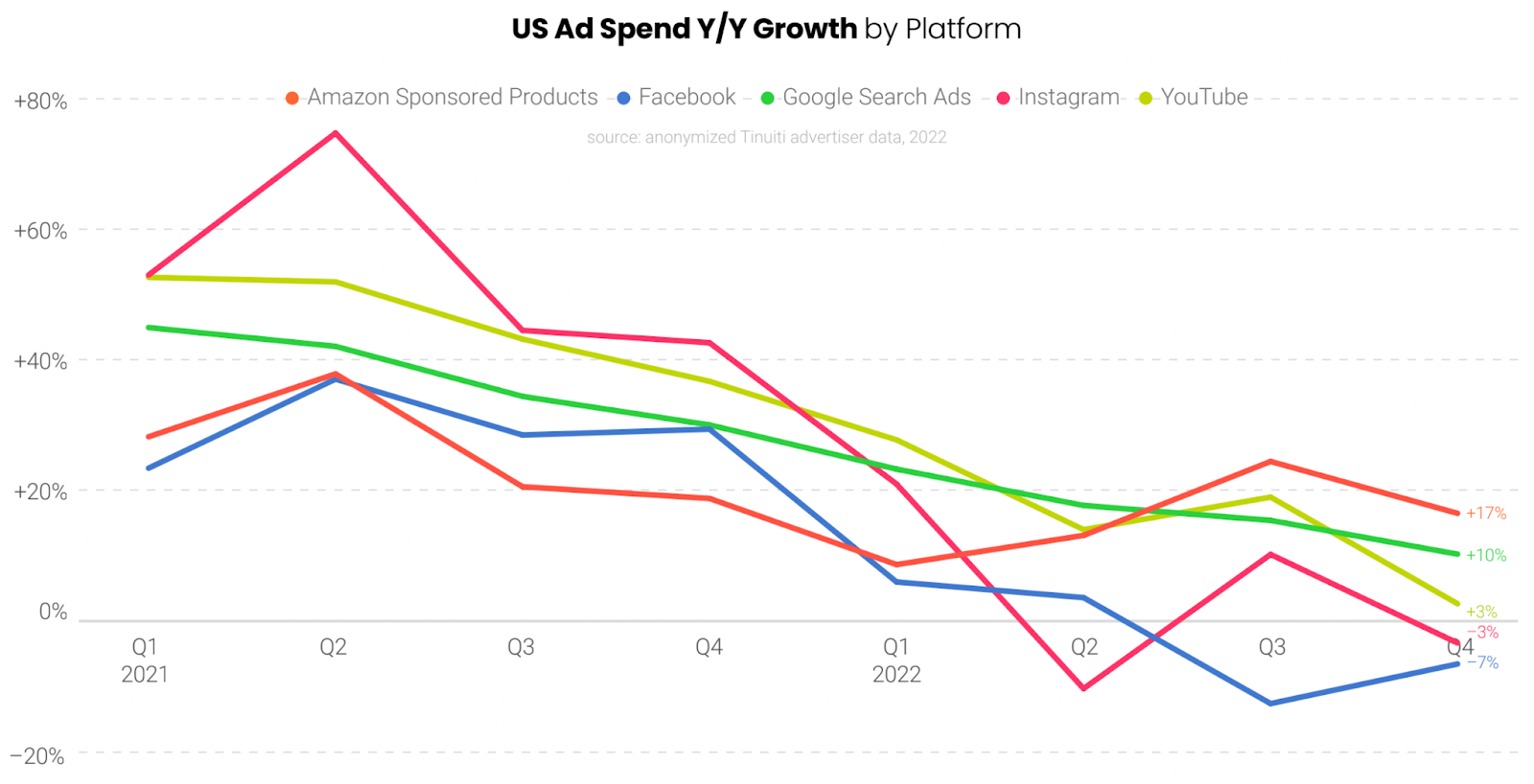

3. As you are surely aware by now, there was a distinct deceleration in digital ad spending in the fourth quarter compared to the prior year, as advertisers were challenged by macroeconomic uncertainty.

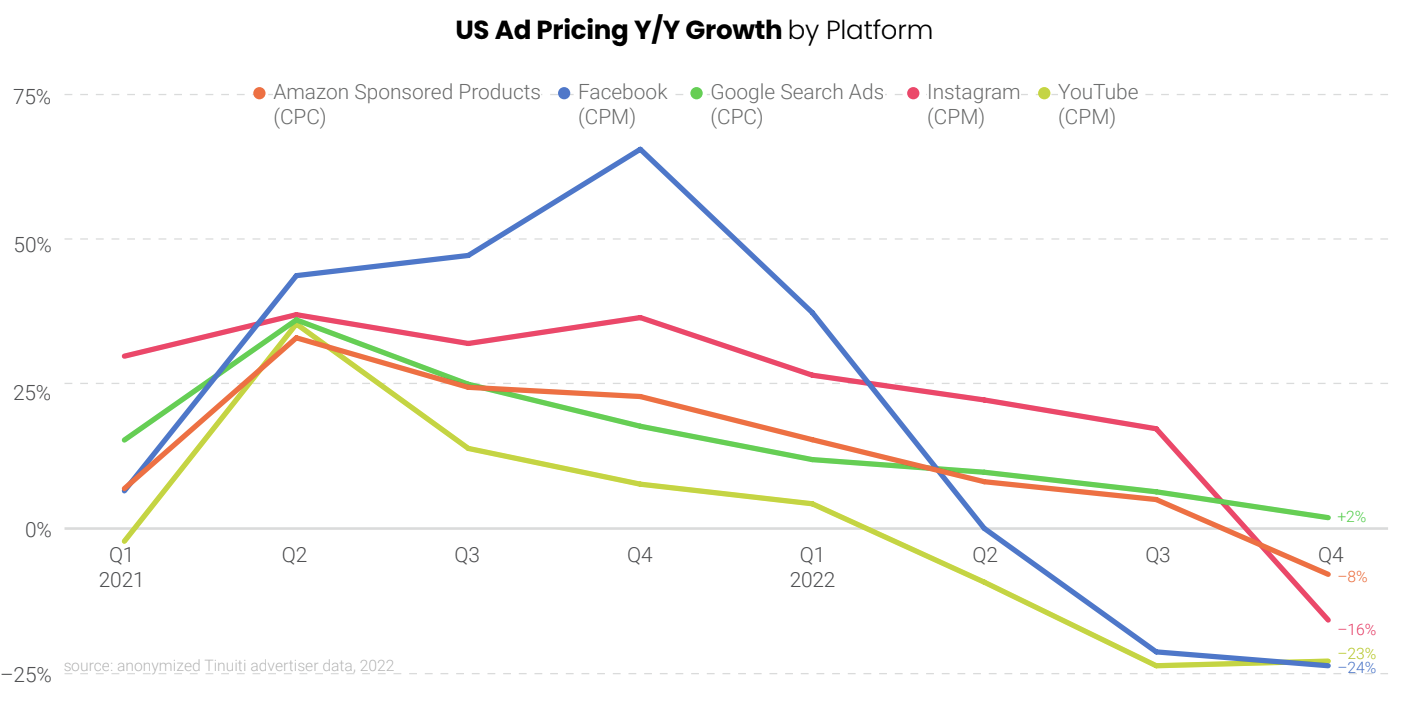

At the same time, ad pricing across the major platforms decelerated, falling from a peak in the second quarter of 2021. Over the past year the supply of available advertising inventory has increased. This presents an opportunity for some marketers, especially those with healthy businesses, as there are unusually appealing buying opportunities.

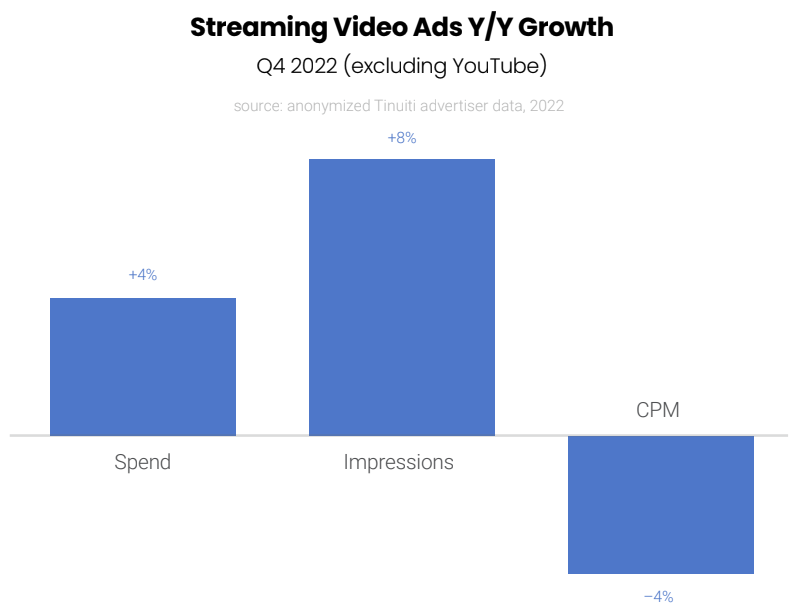

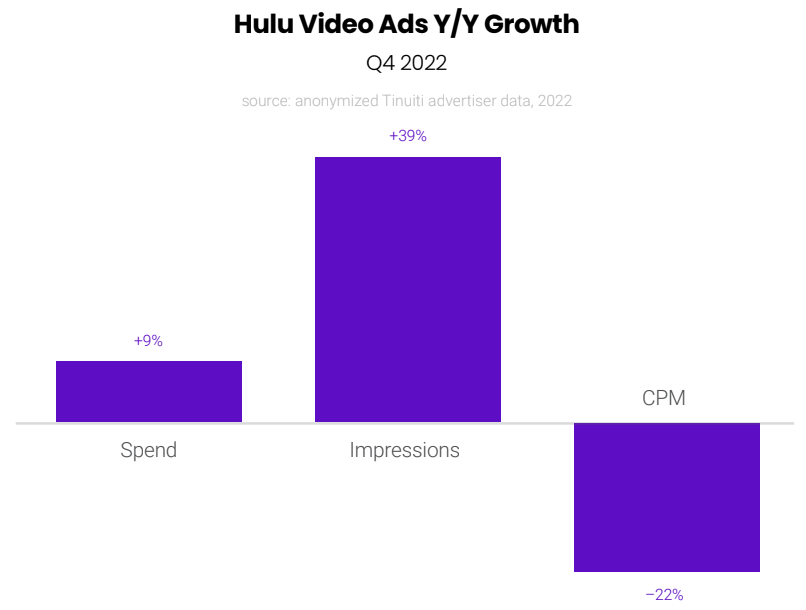

Similarly, in streaming we’re seeing a decline in CPMs and significant discounts on a variety of inventory.

If you would like to read more about the trends in ad spending and pricing across platforms, please see the Tinuiti Digital Ads Benchmark Report for Q4 2022, linked here. | Tinuiti

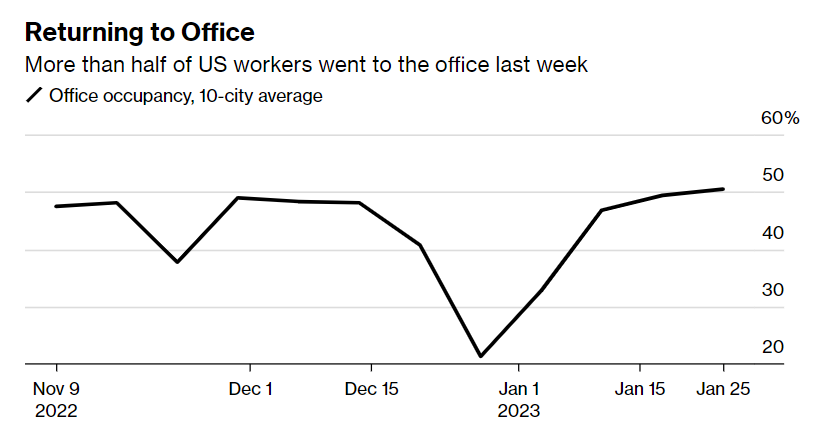

1. One of the lasting impacts of the pandemic on business has been the shift from in-person to remote or hybrid work. This week, office occupancy (as measured by an index of 10 major U.S. cities) reached 50% of pre-pandemic levels for the first time.

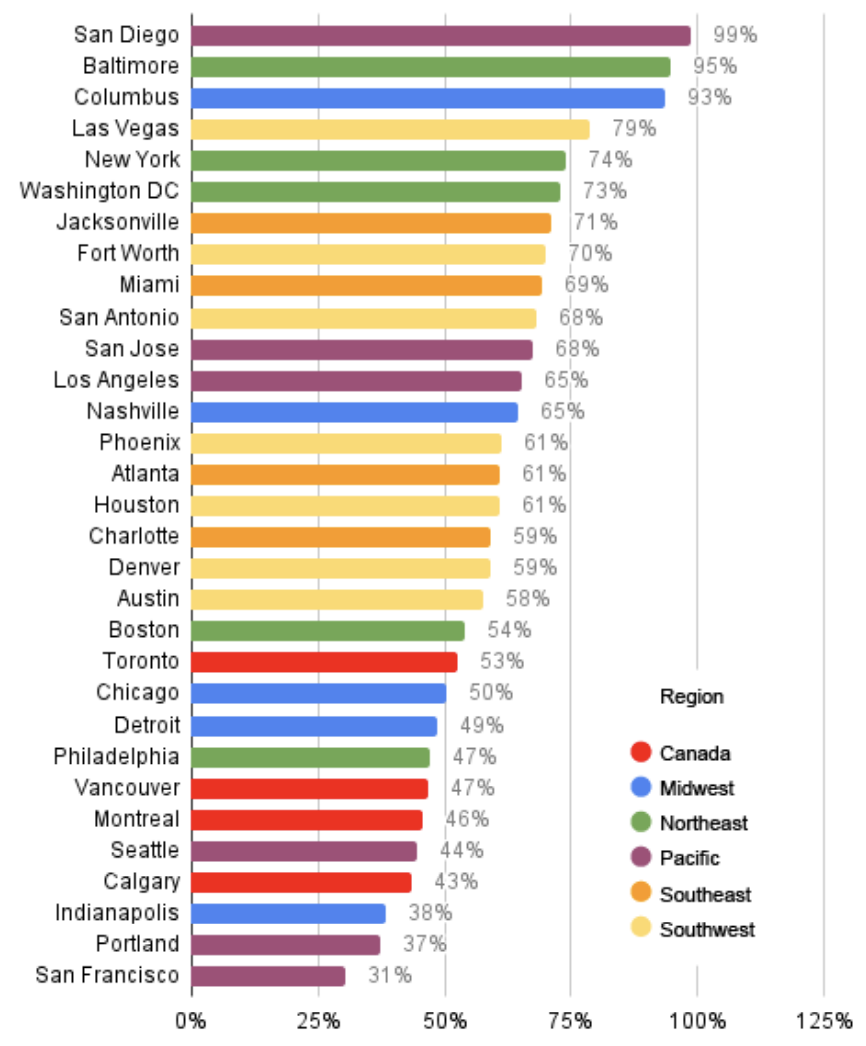

According to analysts, most companies are employing some form of hybrid work as full in-person mandates have been met with fierce protestations from employees. The return to work could be important for many downtown businesses, particularly in the largest U.S. cities, which have been adversely affected by the loss of regular foot traffic. According to a study, downtowns in cities like Los Angeles, San Francisco, and New York are still very far from reaching 100% recovery, while recovery in medium sized cities has occurred much faster. While crossing the 50% threshold is an important milestone, it’s quite possible that downtowns will never return to pre-pandemic levels, and business will continue to move closer to where people live rather than where they work. | Bloomberg, Business Insider

Note: Data reflects recovery as of November 2022

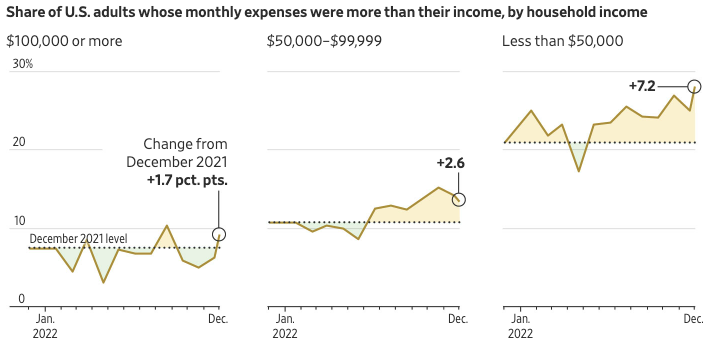

2. As 2023 kicks off, we’re starting to see monthly retail sales falter after a relatively strong 2022. In three of the last four months, consumers tightened their belts and reduced their discretionary spending as the strain of inflation took its toll. Making matters worse, recent data indicates that wage growth is stalling, throwing a wrench into the engine (the labor market) that has helped propel economic growth. To be clear, a cooling labor market is considered to be an important step in reducing inflation, but it may be painful for Americans who are increasingly struggling to cover monthly expenses:

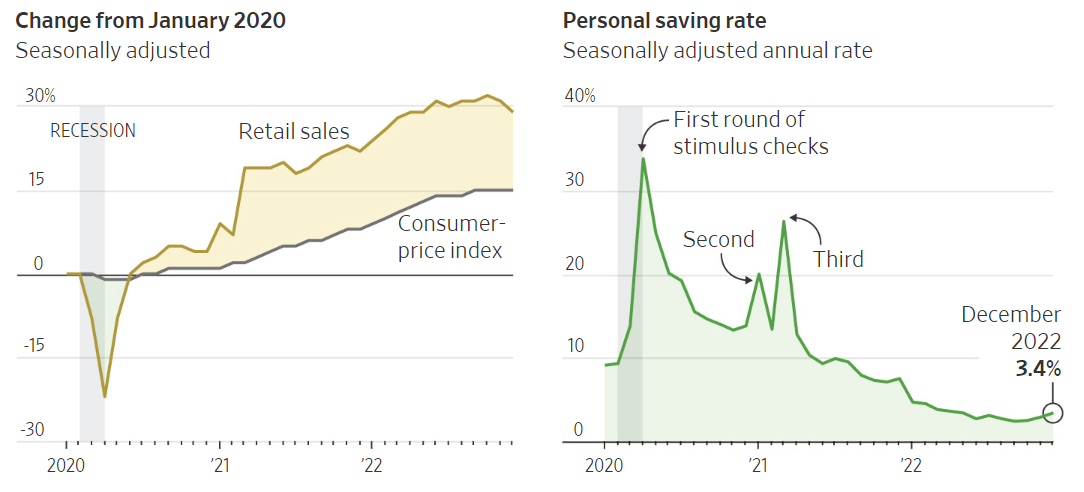

Financial strain came to a point in December, as evidenced by the 1.1% decline in monthly retail sales and the 0.2% MoM decline in consumer spending. Part of this equation is that the personal savings rate rose from 2.9% in November to 3.4% in December. Diligent readers will recall that last year the savings rate fell to levels unseen since the Great Recession, partially the result of the enormous amount that consumers saved during the pandemic.

As the Fed continued its course of monetary tightening with a quarter-point interest rate hike this week, we’ll be keeping an eye on its long-term effect on consumer spending (which accounts for 70% of U.S. GDP). | WSJ