Media Update: Netflix Subscriber Growth, P&G Q4 Results, and The Justice Department Sues Google

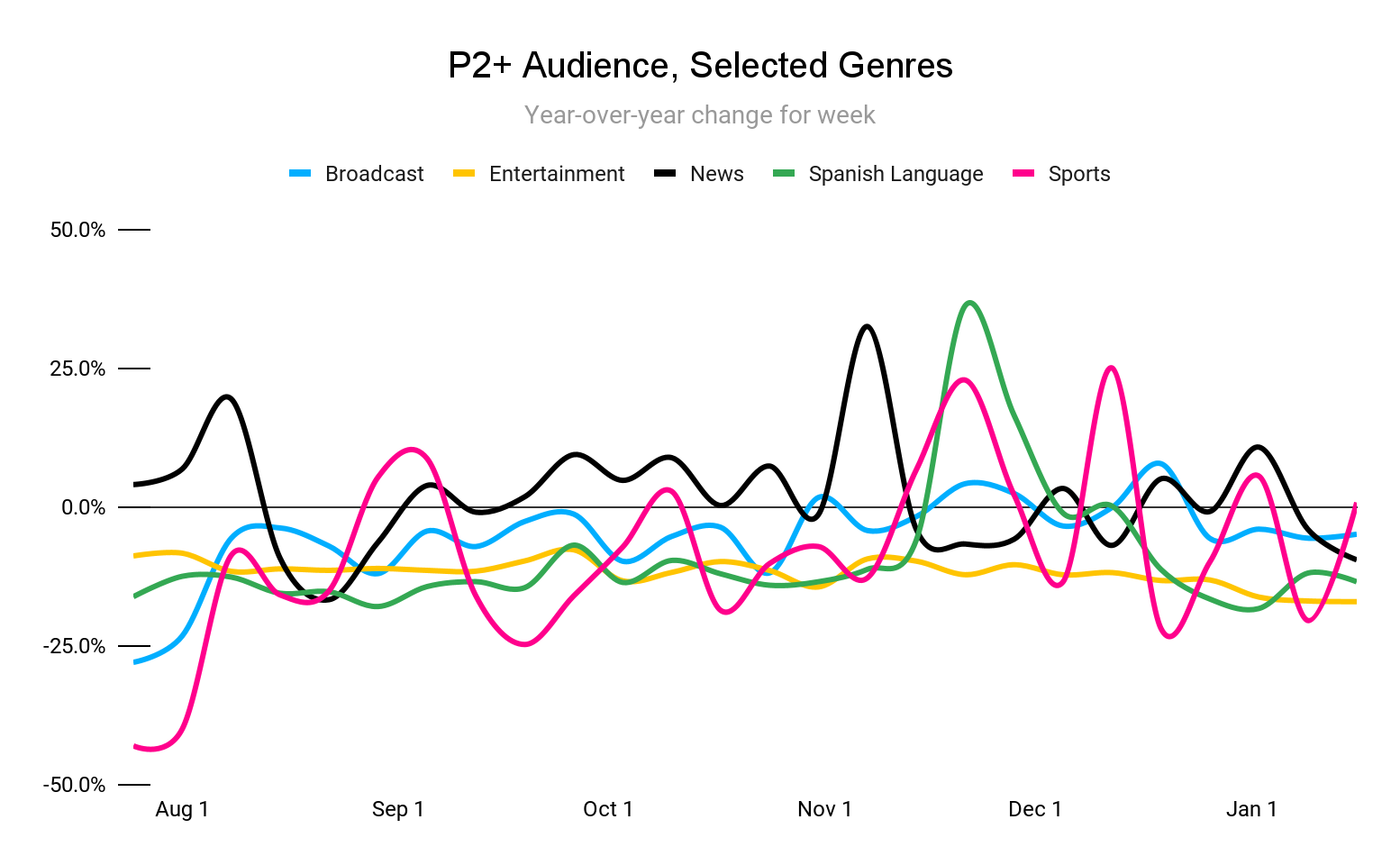

As we foreshadowed last week, streaming viewership looks to have bounced back from a mid-January dip, recovering to the peak established in late Q1 last year.

Industry Notes (Video)

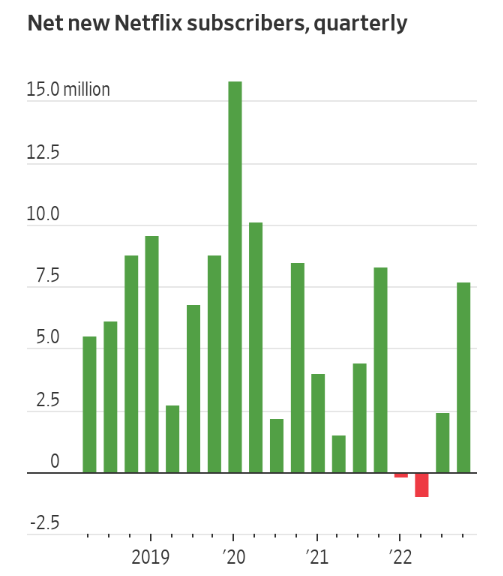

1. In a highly anticipated earnings call, Netflix announced a significant uptick in user growth, netting 7.66m new subscribers, far ahead of its previous guidance of 4.5m additions; revenue growth was more muted, rising 1.8% over Q4 2021.

This was not just any earnings call of course; it was Netflix’s first since its introduction of an ad-supported tier, abandoning its once-sacrosanct principle of shunning ads. While the company didn’t break out any financial details of its new advertising business, it said it is “pleased with the early results, with much more still to do.” Early indications are that the new tier has attracted new, cost-sensitive customers, and that most of the people picking the advertising tier are new customers, not people downgrading from a higher-priced plan.

Notably, the company saw average revenue per user (ARPU) declines across all regions, and those declines were largest where new subscriber gains were largest. This makes sense, given the above point about those choosing the lower-priced ad tier being new, price-sensitive subscribers. Over time, Netflix will surely hope to bring its AVOD ARPU up to parity (at least) with its SVOD ARPU, as its rival Hulu has managed to do through the sophistication of its ad operations. While it works on building and refining its ad business, Netflix warned investors not to expect continued rapid growth in Q1, as its big Q4 numbers probably contain some pull-forward of consumer demand. | Bloomberg, WSJ

2. Speaking of Hulu and its industry-leading ad operation, Disney will begin rolling out more comprehensive ad targeting on Disney+ in April, utilizing Hulu’s ad-targeting capabilities. At the outset, this will only include basic information (age, gender, and some geo-targeting) but the Mouse House plans to bring to market the full suite of Hulu’s targeting, via the Disney Select first-party data platform, in July.

In comparing Netflix and Disney+ (both of which launched ad-supported tiers in Q4 2022), this has always been Disney+’s advantage – the Disney Ad Server has been used by Hulu for years, which allows Disney to immediately capitalize on the years of trial-and-error and learning that Hulu has invested in to build a powerful ad operation in a new category. This not only reduces the amount of backend work required to make the ad-supported tier viable (Hulu already earns more revenue on ad-supported subscribers than ad-free subscribers), but it also allows Disney to connect inventory across platforms, allowing it more flexibility in delivery. Of course, advertisers must allow their spend to be shifted with each deal – but this is not even an option that Netflix, with its singular platform, can provide. Indeed, Disney has not struggled with under-delivery as Netflix has. This move will be a meaningful step towards automating 50% of Disney’s ad sales, a goal the company hopes to achieve before the end of the year. | Digiday

Industry Notes (Audio)

1. A few months ago we explained that TikTok was exploring a music streaming service, despite the expenses it will incur in music licensing costs. Regarding competition, we noted that:

From Spotify’s perspective, a deep-pocketed competitor like TikTok would be bad news, both lessening its already weak leverage vis-a-vis the major labels and as a threat to its ambition to be the platform for all things (music, podcasts, audiobooks, etc.) audio.

Just a few months later, users have discovered that TikTok is testing a podcast feature by allowing audio to play after the app is closed, posing another challenge to Spotify’s audio dominance. The reasoning behind this is fairly obvious – as we’ve discussed ad nauseum, podcast advertising is a rapidly growing sector with lots of headroom. Moreover, compared to music streaming, TikTok faces relatively modest challenges in enabling podcasts, and already has a burgeoning ad business in place.

Not for nothing, podcasting has been more than just audio for some time. A non-negligible amount of YouTube’s viewership is actually podcasts, and one survey even suggests that it is the preferred platform for podcast listening. YouTube quietly launched a podcast hub last year to aggregate this content for users. Similarly, when Spotify made its push into podcasting in 2020 with the $100 million+ acquisition of the Joe Rogan podcast, it was sure to add video to its platform alongside. This is all to say that the distribution of podcasts, and the way that viewers consume them, is still evolving.

Consider also that TikTok is rooted in user-generated content – like YouTube and unlike Spotify. As we mentioned a couple of weeks ago, there is a sense that audio streamers have reduced their dealmaking, pulling back spend and distribution conversations with concern over broader macroeconomic conditions. This is reflected in the nearly 80% drop in new podcast creation from 2020 to 2022:

Therefore, if there is not as much investment in the creation of podcasts from an institutional level, it stands to reason that TikTok is well-positioned to enter this market with its large creator base. | Business Insider, The Verge

With the exception of sports networks, which were roughly flat YoY, all other linear genres were down versus the same week last year. General entertainment programming, where the competition from streaming is most direct, is down ~17% in just the past 12 months.

Industry Notes

1. After some softness in viewership during the wild-card weekend, viewership for the second week of NFL playoffs rebounded a bit. The Cowboys-49ers showdown pulled in the second-largest Divisional Round audience ever, averaging 45.65 million viewers. As the Cowboys frequently drew large audiences during the regular season, the game unsurprisingly ranks as the most watched of the season so far. Viewership for the other games was as follows:

With the exception of the Eagles-Giants game, which was not exactly competitive (sorry Giants fans!), all of the divisional round games set viewership records for their respective time slots. The notable caveat is that the Sunday games (Cowboys-49ers and Bengals-Bills) benefitted from airing later in the evening and the inclusion of out-of-home viewership in Nielsen statistics – changes that went into effect in 2020. On the advertising side, the NFL drew an estimated $1.1 billion in ad revenue, serving 17.7 billion impressions through the first two weeks of the playoffs. This compares with the slightly higher $1.2 billion and 26.2 billion impressions over the same period last year. | SMW, Media Post

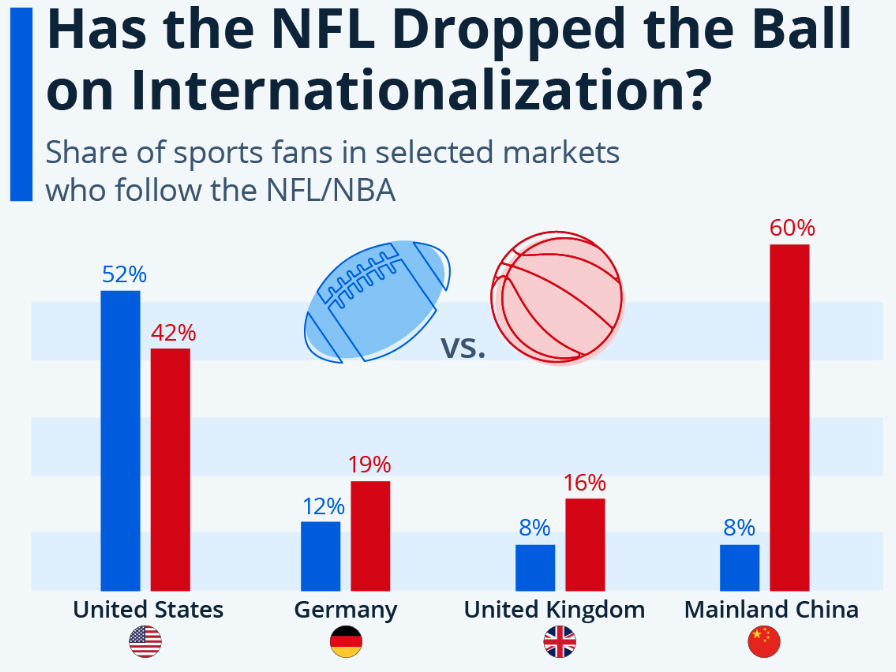

2. This season, the NFL scored record U.S. viewership for its regular season international games. We noted briefly back in October that the NFL is plotting an international expansion (potentially even a team abroad) with more international games than previous years. This week, the NFL confirmed that there will be three games in London next year and two in Germany, marking the first time that five international games will be hosted in Europe. Because these games garner weak viewership in the U.S. compared to other games (owing in no small part to the time difference) they only make financial sense in terms of the international exposure that they provide the NFL.

In a similar vein, the NBA inked a deal with the BBC to broadcast nine more games this season, including some playoffs and one game of the Finals. With its continued expansion into Europe, this deal highlights an advantage that the NFL may be lacking: international players. The NBA is hosting a game in Paris this year and is expecting growth in France because the presumed first-overall draft pick is Victor Wembanyama, a Frenchman. The NFL does not have the same mix of international players, which could be hindering its advancement into European markets – hence the consideration of a European team. From a performance marketing perspective, viewership in Europe is less valuable because of the regulation surrounding data privacy and measurement; but insofar as the U.S. market is saturated, increasing the international viewership could be a significant boon for both leagues, especially as a hedge against audience loss as pay TV subscriptions plummet. | SMW, Front Office Sports

1. Back in May we told you about proposed legislation to prohibit companies processing more than $20 billion in digital ad transactions annually from participating in more than one part of the digital advertising ecosystem, colloquially known as the ‘break up Google’ bill. In July, we told you about Google’s attempt to forestall government intervention by offering to spin out the part of its business that facilitates ad auctions and ad serving (which has its origins in Google’s 2007 acquisition of DoubleClick) into a separate entity under the Alphabet umbrella.

It appears that olive branch has been spurned, as this week the Department of Justice filed suit against Google, accusing the company of abusing its monopoly power in the digital ad auction market; the suit seeks the unwinding Google’s acquisition of DoubleClick (from 2007!) and the divestiture of its ad exchange. Unsurprisingly, Google has responded forcefully, arguing that its products have helped both publishers and advertisers; that many other advertising tools used by other companies work very similarly; and that participants in the digital advertising ecosystem are under no obligation to use Google’s tools.

The intricacies of a case like this are enough to make you glad you didn’t go into technology law. At a high level, the government’s case centers on the fact that Google has attained dominant positions in three critical areas:

(Note for you ad tech gurus: some of these products go by different names now, but these were the names at the time of the alleged anticompetitive behavior)

Since we are not antitrust lawyers we will not opine on the merits or likely outcome of the case; for that, we will punt to the ever wise Ben Thompson!

… I actually do think that Google is abusive in the ad space, and if regulators are going to pursue a potentially-doomed antitrust case this is the 2nd most important one I think they can pursue (number one is of course the App Store).

… The most likely outcome, though, is that this case highlights exactly where current law is deficient in limiting big tech companies. I’ve long argued that the only way to actually effect change is legislatively; when it comes to antitrust, Supreme Court precedent is controlling, but it’s an interpretation of law, not a Constitutional right. If Congress doesn’t like the interpretation they can change the law!

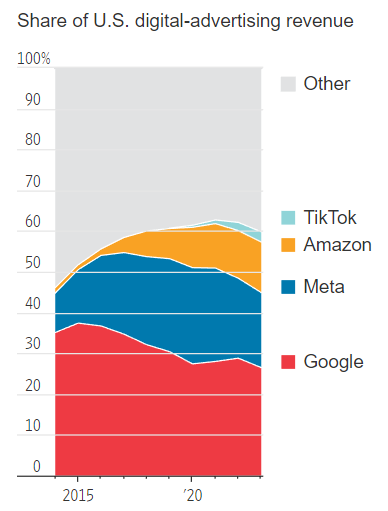

The timing of the suit is a bit ironic, as Google’s share of the market for digital ads has consistently eroded in recent years:

Indeed, its model is under sufficient pressure from TikTok, Amazon, and ChatGPT that informed observers are already declaring The Duopoly Is Over. A similar dynamic was at play in the 1990s when the DOJ went after Microsoft’s OS (Windows) and browser (Internet Explorer) dominance, which in retrospect were much less impregnable than they seemed. In any event, this case, alongside another ongoing antitrust suit filed by the federal government and 11 states in October 2020, is likely to have major implications for the future structure of digital ad markets. | WSJ, Stratechery

2. Speaking of digital advertising and alleged abusive behavior by gigantic companies, the Internet Advertising Bureau (IAB), the digital ad industry’s largest trade organization, publicly blasted Apple for its approach to advertising: “Apple is fine with advertising, as long as they get to control it on their terms … Apple exemplifies the cynicism and hypocrisy that underpins the prevailing extremist view.”

As we’ve discussed many times previously, Apple’s introduction of App Tracking Transparency with the release of iOS 14.5 in April 2021 altered the digital advertising ecosystem radically, with the fallout continuing to be felt to this day. When you hear (as you endlessly do, if you’re in our line of work) about “signal loss,” this is the major signal that has been lost, and it’s broken many advertising models. While Apple has been circumspect about its advertising business and ambitions, it clearly wants a big slice of the pie:

It is difficult to look at these data points together and conclude that Apple might not really be interested in becoming a major player in the ~$600 billion digital advertising market.

What industry participants seem to want is simply more engagement from Apple. In contrast to Google, which laboriously telegraphs its policy changes and solicits industry input, Apple has tended to announce and implement policy changes quickly and with little to no external consultation. We won’t hold our breath for Apple to change its stripes, but it has a needle to thread in maintaining its image as the consumer privacy champion while it scales up an enormous ad business. | AdExchanger

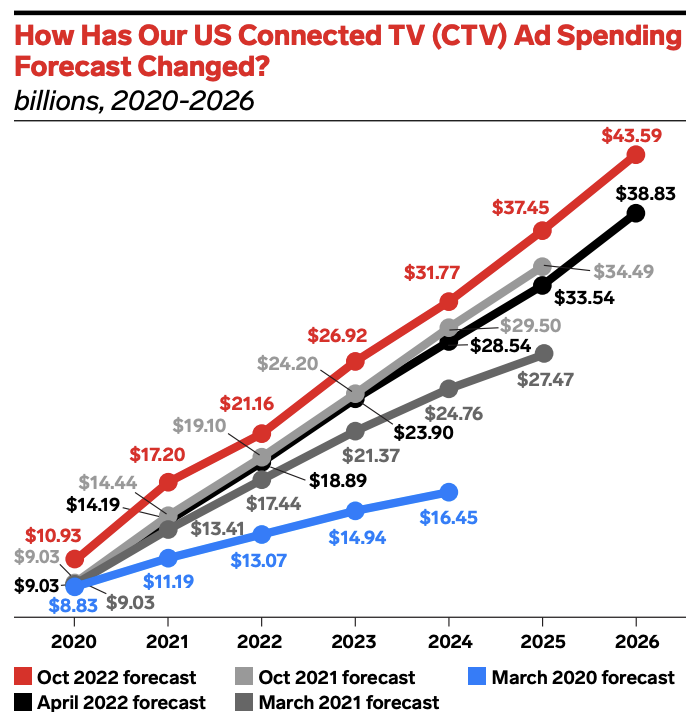

3. Insider Intelligence/eMarketer has revised its CTV ad spending forecast to $26 billion in 2023, as a result of the increased number of ad-supported services now available. This estimate has increased significantly from year to year, as the trends in television consumption have accelerated in the direction of streaming. Additionally, you’ll notice that the October 2022 forecast is raised on the y-axis – even for past years – as a result of the evolving CTV landscape, and increasingly comprehensive definitions. Per eMarketer, this measure now includes “free services (like Pluto TV and YouTube), ads that appear on TV screens via social video (like TikTok), ad revenues from operating systems (like Roku, Fire TV, and Samsung), and ad tech fees associated with CTV ad buying.” As streaming penetration rises and the sector matures, CTV ad spending is projected to double between 2022 and 2026, beginning with a big acceleration this year. | eMarketer

4. U.S. ad spending continued to decline in December, contracting 12.1% on a YoY basis. As we mentioned with news of the fall in November, we are now in a retrenchment period as ad spending growth moderates compared to last year.

The graphic below reflects a new dataset that has been expanded with more granular digital data to provide a comprehensive assessment of the advertising market. Based on the new index, last year’s positive changes were larger, and negative changes more muted. Using this more detailed view, December’s decline represents the largest monthly drop in U.S. ad spending for all of 2022. | Media Post

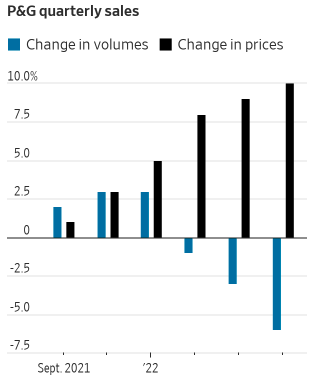

1. Proctor and Gamble (P&G) gave markets one of the first glimpses into Q4 consumer-products spending with its earnings last week. P&G reported a 6% decline in sales volume, but a 5% increase in overall revenue, amidst rising prices for consumer staples such as Tide detergent. The results seem to indicate that consumers indeed pulled back their spend towards the end of the year (as we discussed in the context of the holiday shopping season), as price signals worked their magic in rationing demand under supply constraints. | WSJ

2. There were significant tech layoffs yet again this week. The latest to course correct due to over-hiring and moderating revenue growth includes giants Google and Microsoft, and smaller companies such as Spotify. At Google and Microsoft, those layoffs represented only about 25% of their total hires in 2022. It is important to note that these layoffs are not negligible for tech, but payrolls may have been unintentionally inflated as a result of a relatively consistent rate of hiring:

Tech layoffs appear drastic because a large percentage of total staff was added in just the last few years – Meta and Amazon have roughly doubled their employees since 2019.

This is to say that there is not yet a huge cause for concern in the tech industry, or the effects on broader macroeconomic conditions. In some cases, layoffs are also accompanied by the shutting down of projects, but these are typically capital intensive and unprofitable in the near term. For consumers, the impact is likely unnoticeable, and the job market remains remarkably healthy (though we are beginning to see notable moderation in wage increases). | Stratechery