Media Update: New TVREV Projections, Modest NFL Playoff Viewership, and Declining December Retail Sales

Streaming viewership dipped in the second week of the new year, though in recent days it appears to be bouncing back to more elevated levels.

Industry Notes (Video)

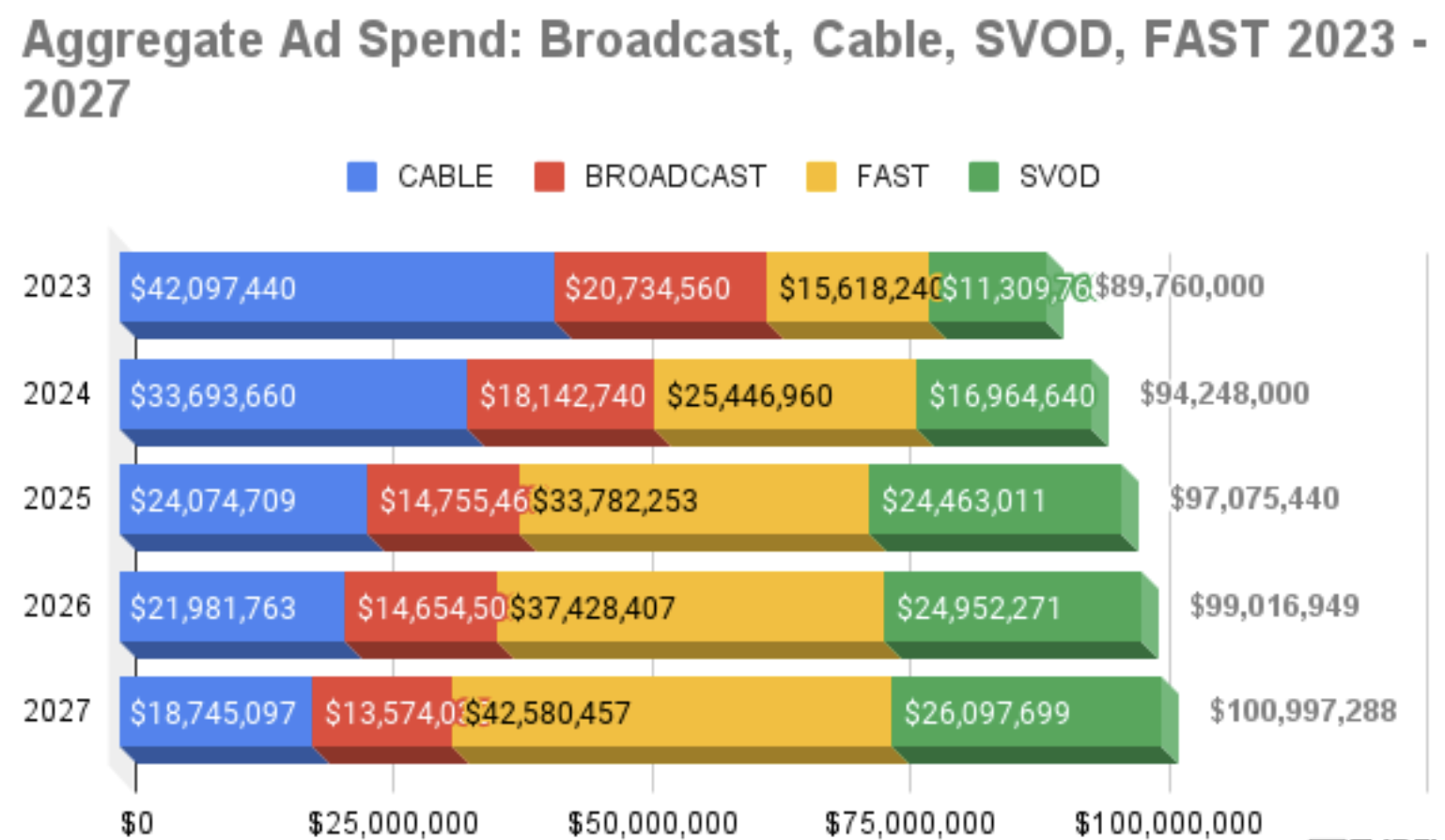

1. TVREV is projecting that FAST ad spending will exceed linear by 2025. The projection is based on current growth rates, which sees FAST taking ad spend from cable and broadcast in significant amounts this year and next.

As we have discussed frequently in the past, the progression in the industry towards ad-supported video is a natural result of rising content costs and the maturation of the sector. While much of 2022’s focus was on AVOD vis-à-vis Netflix and Disney+, there is growing interest in providing a third, free tier of programming. At present, among the “premium” services, only Peacock offers a FAST tier, but Max (fka HBO Max/Discovery+) is scheduled to launch with a FAST service later this year. The more established players, such as Tubi, Pluto, and Roku, are seeing their numbers rise as SVOD prices increase. This is to say that FAST is ripe with potential, and it is possible – and even likely – that we will see FAST products proliferate across streaming platforms in the near future, driven by both consumer and advertiser demand. | Media Post

2. Not to be left behind, YouTube is testing the rollout of FAST channels on a dedicated hub, reportedly planning for a go-to-market sometime this year. As we touched on last week, YouTube is progressively establishing itself as a formidable player across a variety of streaming sectors (live, ad-supported, and now FAST). While it is not first to the punch, the company has a built-in advantage in its expansive video ecosystem and ubiquitous distribution, which was demonstrated when Shorts surpassed TikTok in monthly users (1.5B vs. 1B) despite launching years after. Adding FAST programming, in the context of YouTube’s multi-pronged strategy to become the streaming hub, seems like a bit of a no-brainer. With this, the company will offer television programming for every level of consumer, whether they want to watch for free, buy/rent content, subscribe to SVOD services via their Channels product, or catch linear TV and sports via YouTube TV. | MediaPost

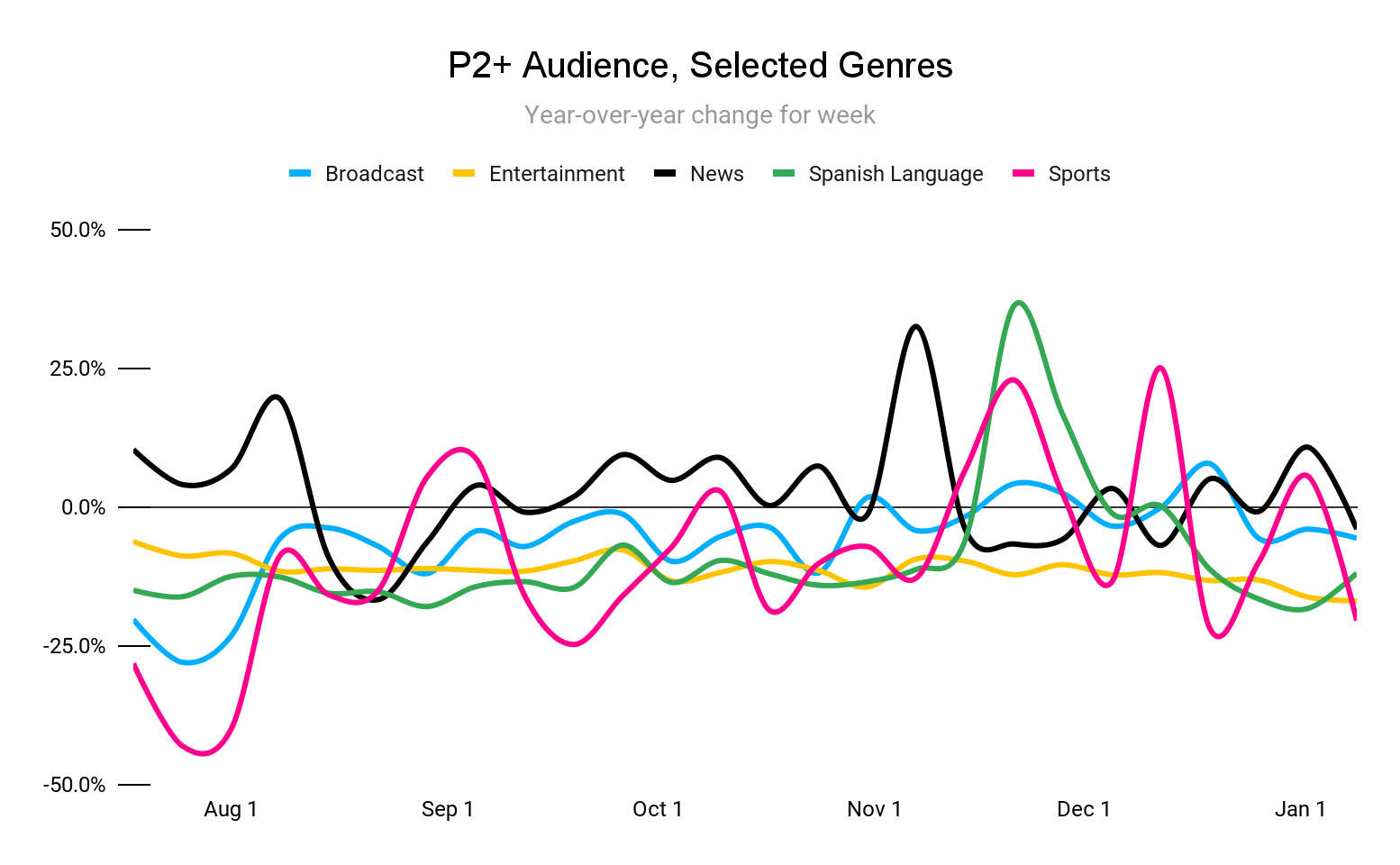

3. While it failed to set a new viewing share record for the first time since February 2022, streaming was once again the most watched form of TV in December, claiming 38.1% of total viewership.

It’s a well known story by now, but the rise of streaming has been remarkable – on a year-over-year basis, streaming usage in December was up 46.1%, yielding a 10.4-point increase in its viewing share. As you can see in the chart heading the linear section below (and as you can surely guess), linear broadcast and cable categories are in secular decline.

We’ve highlighted numerous times the impressive fashion with which YouTube has established itself as a streaming force – while its share declined very slightly in December, it maintained a 1.2-point gap above Netflix.

Also notable in the streaming breakdown is the emergence of Peacock, which for the first time exceeded the 1% viewership threshold to be broken out from the ‘Other’ category. Peacock was something of a latecomer to the market considering its major media pedigree, and it has invested significantly less in content than some of its major rivals; but maneuvers like clawing content back from Hulu and securing exclusive rights to sought-after sports have clearly begun to win over viewers. | Nielsen

4. With the NFL regular season now finished, it seems fair to say that overall season viewership exceeded expectations, despite being pulled down by Thursday Night Football on Prime. Depending on how you slice it, TNF viewership was down 30-40% compared to last year and thus resulted in regular season games averaging 2% less viewership overall (16.7m vs 17.1m). This number would have undoubtedly been lower had FOX and CBS not notched their most watched regular seasons since 2016.

TNF’s average viewership came in at 9.58 million according to Nielsen, and 11.3 million by Amazon’s own count – while Nielsen and Amazon’s divergent counts is an interesting issue, both figures are short of the 12 million that it promised to advertisers. This presents a bit of a problem for the platform, which is reportedly refunding advertisers for missing the mark by 25%. The road to profitability for TNF on Prime is not an easy one, considering that Amazon is spending $1 billion annually for exclusive broadcast rights. After introducing CPMs at $80 (nearly double the rate for inventory on broadcast), Amazon capitulated to demand and lowered the price to $60. The rationale – that Prime has a distinctly younger, hard to reach audience – was proven out as viewership in the 18-34 demo increased 18% over last year. The question for advertisers next year will be whether this demographic shift is sufficiently valuable to warrant the higher CPM. To Amazon’s credit, this was the first year of an experiment, and next season it will benefit both from experience and from a blockbuster new Black Friday game. | Ad Age, SMW

5. Just six months after developing its own DTC platform, Sinclair’s Bally Sports has signed 19 regional sports networks (RSNs) to a carriage deal with FuboTV. If you’ll recall, FuboTV dropped Sinclair’s RSNs at the beginning of 2020 because carriage fees were “not consistent with [its] mission to provide value and keep costs low for consumers.” It was a bold move for the vMVPD, which had built its brand around sports content – but back then, it was more important to platforms like YouTube TV and FuboTV to keep prices low and undercut cable. However, the lack of RSNs has not slowed down the pace of price increases much; in 2023, the monthly base plan for FuboTV is $75, and $65 for YTTV. Bally Sports+ (the DTC platform) is priced at a whopping $20 for in-market teams, evidencing the value of RSNs and the cost to vMVPDs.

The move back to FuboTV is just one in a series of blows dealt to sports on traditional television, and therefore the linear ecosystem altogether. To summarize, in just the past year New England Sports Network (NESN) launched the first DTC RSN, Sinclair followed with Bally Sports+, the LA Clippers launched its DTC ClipperVision, Amazon became the exclusive broadcaster of Thursday Night Football, YouTube TV secured NFL Sunday Ticket, and it was reported that NBCU is looking to add its RSNs to Peacock. Needless to say, the momentum in sports is definitively in the direction of streaming. While 2023 likely won’t be the year that the cable bundle dies completely, with the rise of specialized sports streaming products, it seems all but certain that cable subscriber losses will continue to accelerate as sports fans turn to streaming alternatives in larger numbers. | Fierce Video

Following a viewership surge around the New Year holiday (and associated high-profile sports), all linear categories were down on a YoY basis in the third week of 2023.

Industry Notes

1. As we noted above in our discussion of Amazon’s first season as the exclusive home of TNF, total viewership for the NFL’s regular season was down 2% from the 2021 season. That softness in viewership carried over into the first weekend of the NFL playoffs, with four of the six wild card games seeing audience declines from last year. Both the Giants-Vikings and Chargers-Jaguars games declined by more than 20% compared to the same games last year, while Ravens-Bengals and Seahawks-49ers declined by single digits. The linear audience for Chargers-Jaguars is the lowest on record for a primetime NFL playoff game and the fourth-lowest of any Wild Card game in at least 20 seasons.

As ever with sports, matchups drive audiences – the two games that saw YoY audience gains were Bills-Dolphins, with the Bills in the spotlight recently following the dramatic Damar Hamlin episode; and Cowboys-Buccaneers, featuring the perennially popular Dallas facing living legend Tom Brady.

It is important that we keep this in context – while regular season audiences were slightly down, and a few playoff games were significantly down, these are still by far the largest audiences on television. The aforementioned Giants-Vikings game attracted 33m viewers, which is about 3x the viewership of the most recent NBA Finals and the most recent World Series; and about 5x the viewership of the most-watched dramas on television (if you’re curious, that’s “The Equalizer” on CBS). | SMW

2. We told you back in October about LIV Golf, an upstart competitor to the PGA Tour that was launched, and lavishly funded, by the sovereign wealth fund of Saudi Arabia. The league sought out television coverage, but was turned down by NBC, CBS, ESPN, Apple TV+, and Amazon Prime Video due to existing deals with the PGA and concerns over the league’s controversial provenance. The net result was that the LIV’s first season saw coverage exclusively online, including free streams on YouTube.

LIV Golf has, at long last, reached an agreement for U.S. TV coverage with the CW. Starting next month, the circuit’s events will air on the CW’s television network as well as its streaming app. While financial terms have not been disclosed, sources close to the deal have confirmed that LIV will not be purchasing airtime from the network; assuming that scenario is ruled out, it seems likely that the CW’s rights fees to LIV, if any, will be extremely minimal. | NYT, WSJ

3. The fourth quarter brought another disappointing loss for Dish Network: 191,000 satellite subscribers and 70,000 Sling subscribers dropped the service. Although losses were slightly better than Q4 2021 (203,000), Dish now has about one-third the number of subscribers it had at its peak in 2009. Last quarter the company actually netted 30,000 pay TV subs because of gains at Sling, but growth at the vMVPD is close to zero. With the continuous loss of its base of rural subscribers, it seems unlikely that Dish will ever be able to rebuild its subscriber base to previous levels. | Fierce Video

1. WideOrbit will be launching a buy-side platform that provides access to broadcast TV inventory in 187 (out of 210) local markets. The platform, dubbed ZingX, will connect to WideOrbit’s sell-side exchange, which should improve the ease with which buyers can access broadcast TV inventory at scale.

At Bliss Point, our two-year partnership with WideOrbit has made broadcast TV extraordinarily simple for our clients to activate, putting large audiences and scalability at our fingertips. The addition of broadcast TV complements our branded performance approach with patented tech to build brand value, acquire customers, and boost digital conversions. | NextTV

2. Two years ago, Instagram integrated a ‘Shopping’ tab on its in-app navigation bar to capitalize on the social commerce market, which is projected to grow three times as fast as ecommerce. Now, IG is dropping the Shopping tab and replacing it with a Create button. This move demonstrates how IG is being pulled in different directions: should the platform be about sharing with your friends or exploring your interests (like it is on TikTok)? The latter option means that the platform should be a place to drive discovery and engagement with stuff you might like, potentially improving the quality of ad targeting. But there is pushback from users, albeit anecdotal, against the TikTok-ization of the social media site, regardless of IG’s claims that Reels drive engagement.

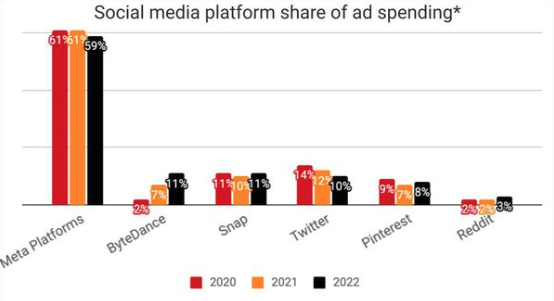

The challenge for IG is that TikTok is not just stealing eyeballs, but advertiser dollars as well. According to the latest measurement by Standard Media Index, TikTok (ByteDance) has increased its share of social media ad spending by nine points in the last year, while Meta has declined 2 points. This data represents spend through major agencies, which are likely a minority of ad spend on social media as most revenue comes from small to medium sized businesses. However, the fact remains that TikTok is becoming more standard in social media marketing mixes and is defying the advertising slowdown. Instagram’s struggle to find itself might be costing the platform serious dollars, and the shift away from shopping might be an indication that it is gearing up for yet another change in focus. | Marketing Dive

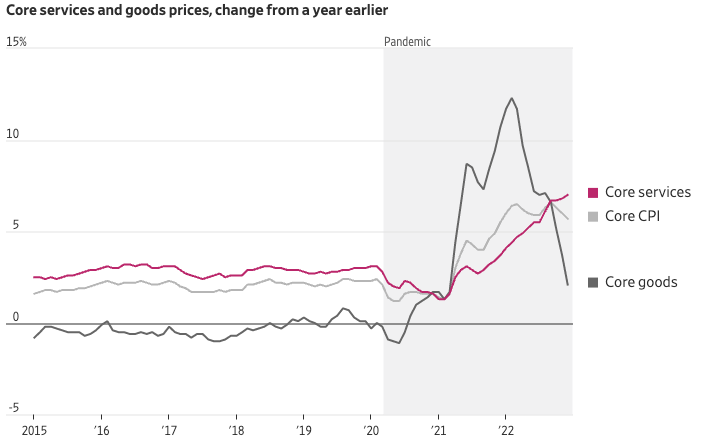

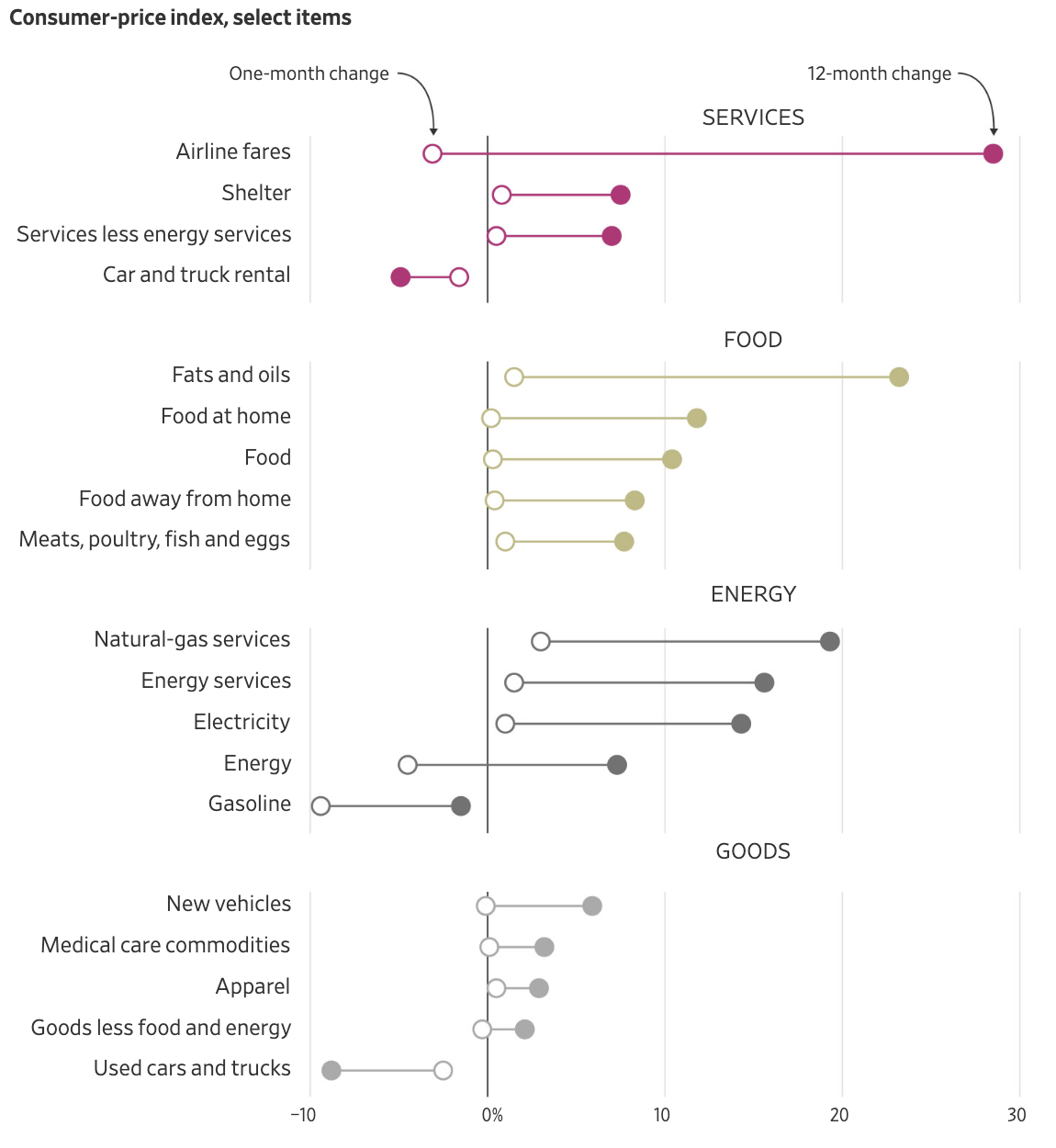

1. In positive economic news, December yielded yet another month of declining inflation.

On a monthly basis, core CPI (CPI less volatile food and energy prices) rose 0.3% in December, up slightly from 0.2% in November, but still noticeably below the 0.6% increases in August and September. Additionally, shelter costs, which represent roughly 40% of core inflation, rose 0.8% over the same period – meaning that the overall uptick is largely attributable to the rise in this one sector (grouped in “core services” in the chart above). To note, the CPI does not take into account newly rented housing units, and is thus missing the fact that rents are dropping at the fastest pace in 7 years. As with all lagging indicators, we should expect to see the effects show up in the coming months. | Econlib

2. In related news, the Department of Commerce reported that retail sales fell 1.1% in December and 1% in November (revised from 0.6%). Although these numbers are seasonally adjusted, they do not account for the drop in inflation, which caused overall consumer prices to drop 0.1% in December, the first monthly decline since May 2020.

The falloff of sales across electronics stores, car dealerships, clothing outlets, and department stores was expected, as many major retailers pulled back their sales forecasts ahead of the holidays. We will have a better understanding of how individual retailers fared when 4Q earnings are released next month, but overall it is clear that consumers are tightening their belts. | NYT, WSJ