Media Update: Streaming Video Claims Over 38% of Total TV Time, NFL Sunday Ticket, and U.S. Consumer Confidence

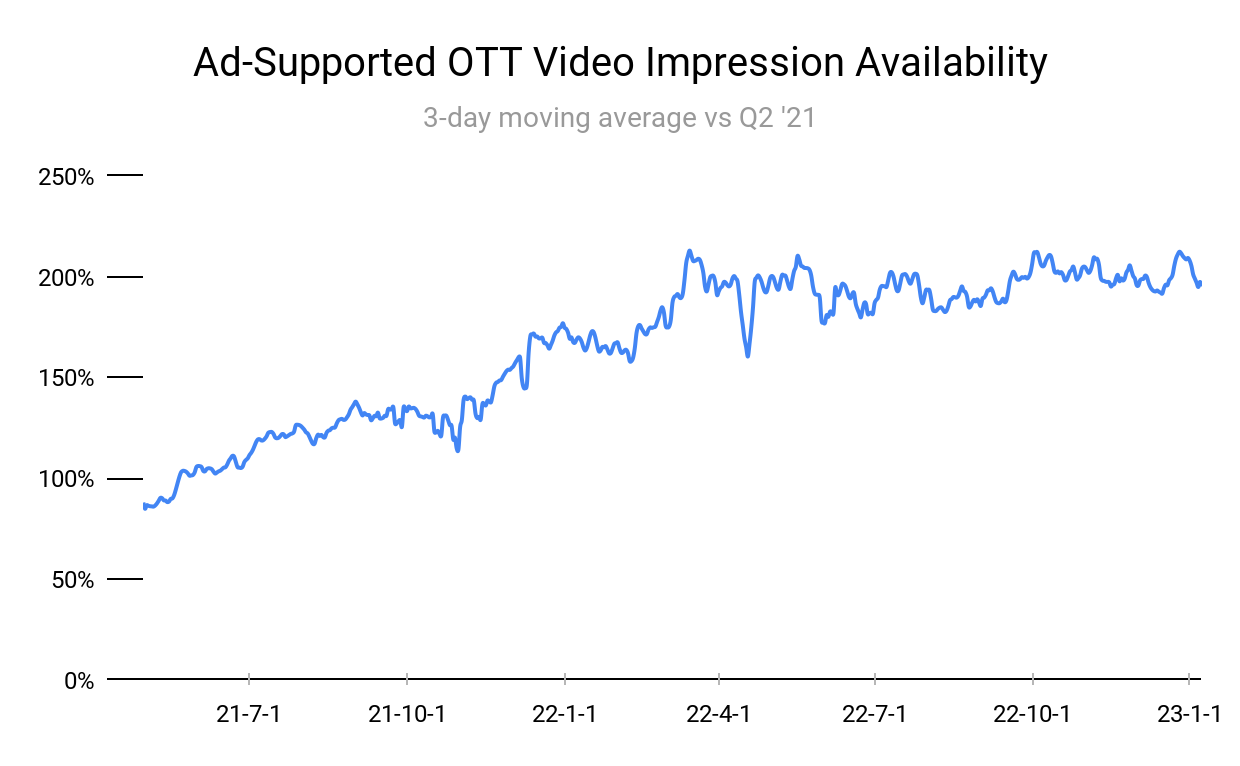

We did not see any major uptick in OTT viewership in Q4 – in fact, the level of aggregate supply has remained quite steady over much of the past three quarters. The secular trends of cord cutting and streaming adoption will continue to expand the number of addressable eyeballs, but streaming’s rapid growth spurt may now be behind us.

Industry Notes (Video)

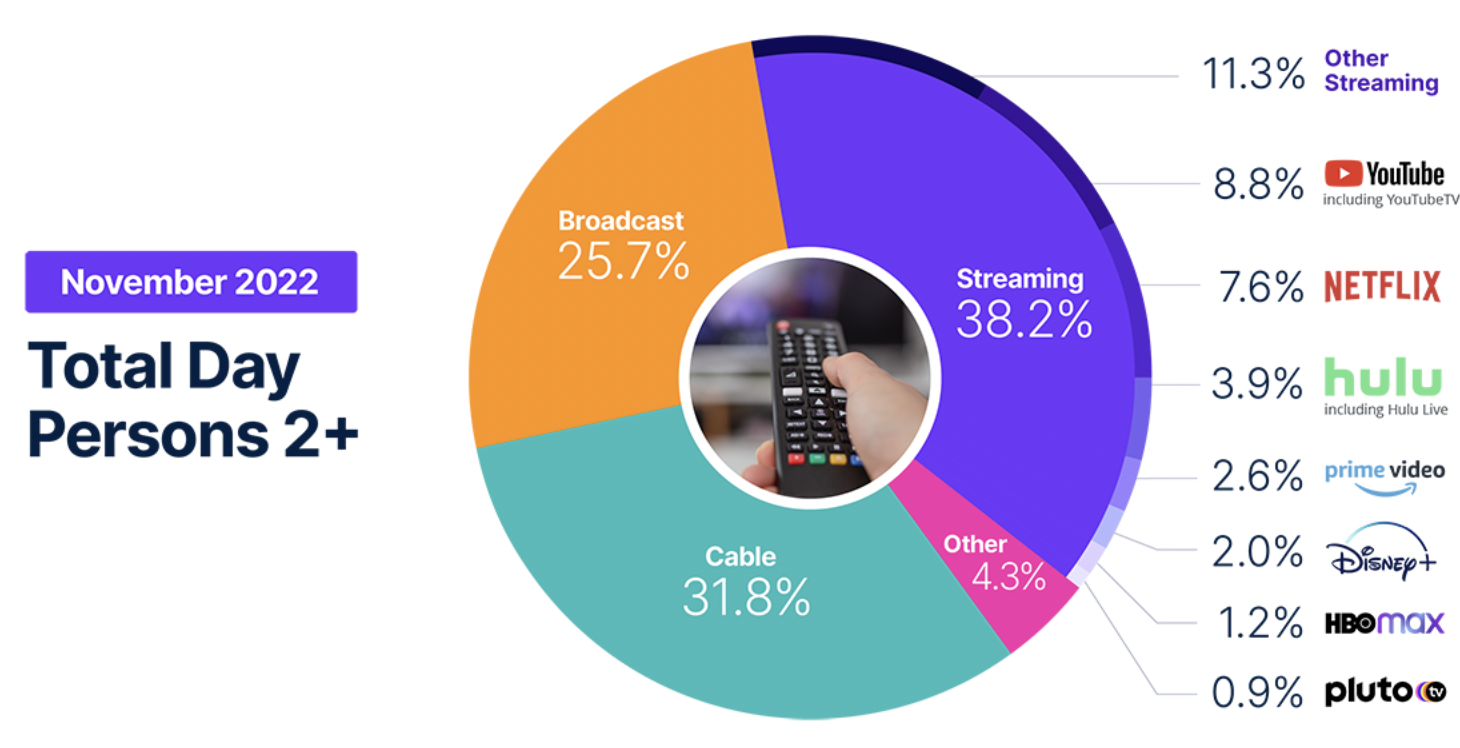

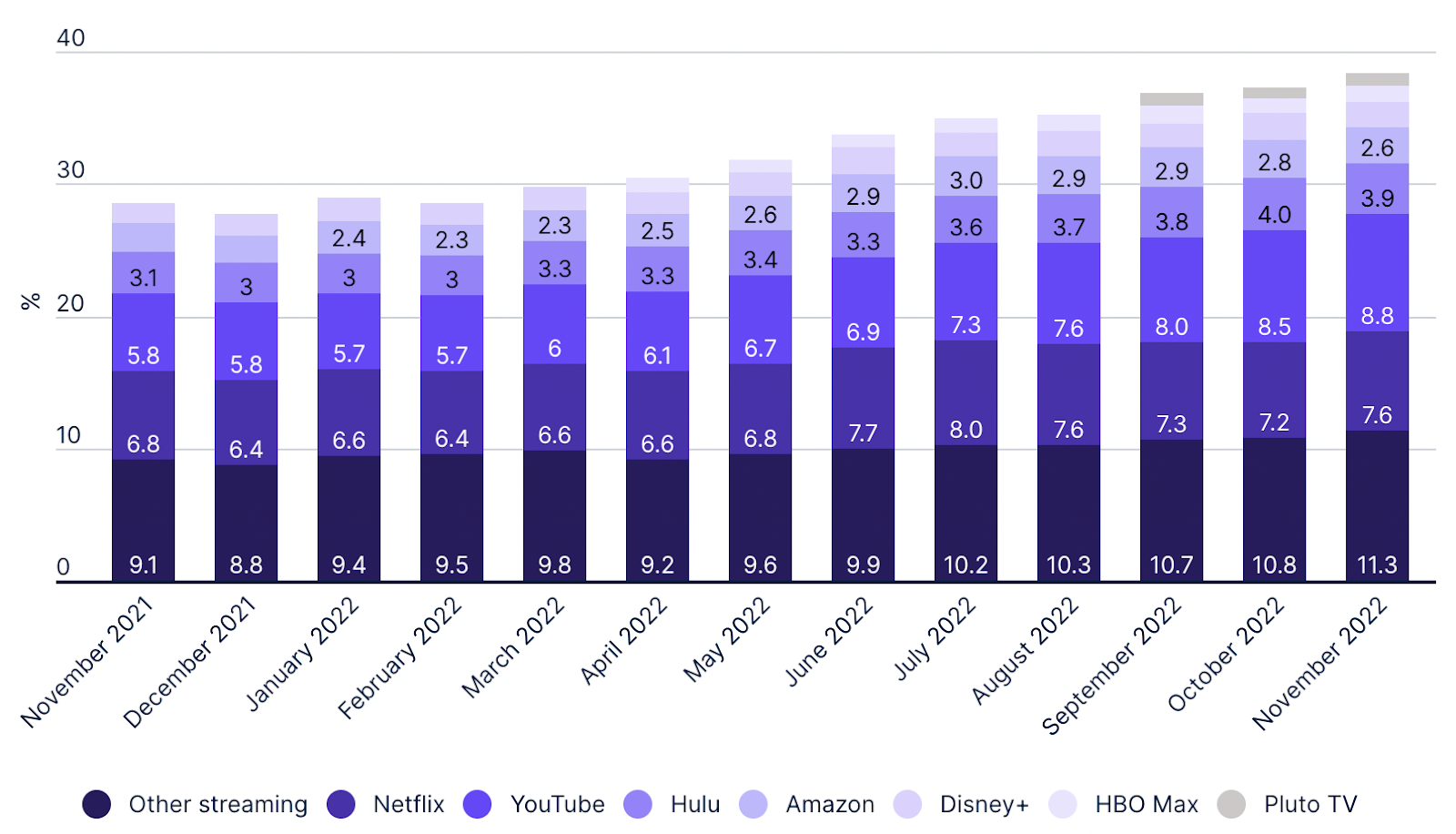

1. Nielsen released its latest viewing statistics over the holidays – total TV usage soared in November, up 7.8% over the prior month, propelled by Thanksgiving viewership and sports such as the NFL, World Series, and World Cup.

With streaming increasing yet again, the category has achieved a near 10-point gain in share in 2022. A couple things to note from this month:

This impression was only reinforced when Netflix tapped Microsoft as its ad tech and ad sales partner in lieu of standing up those capabilities internally, and then brought its ad product to market in November, a mere seven months after that April earnings call. Given the rush to market, it is unsurprising that the launch of ads has hit a few bumps in the road – what is a little more surprising is that Netflix has missed its impression delivery targets by enough that it is giving money back to its upfront advertisers.

This was a risk of eschewing the share-of-voice model, which many platforms embrace at launch given the uncertainty of impression delivery – they promise advertisers a specific share of impressions, rather than a specific number, which affords the platform some downside protection. And to contextualize Netflix’s miss, under-delivery is far from unheard of, indeed it’s quite common in the upfront advertising world; what is uncommon is giving money back rather than rolling the liability forward to future audience delivery. It suggests that Netflix wants to avoid putting additional pressure on itself by accumulating liabilities while it is still building its ad-supported audience; it may also suggest a longer timeframe for ~$60 CPMs to come down to earth. | Digiday

2. After several years in development, Nielsen is at long last bringing Nielsen One, its cross-screen measurement solution for the digital age, to market – sort of. On Wednesday this week, One became available to Nielsen clients and the product will report linear TV data based on “today’s average minute currency” for buying and selling. One also integrates “big data” from set-top boxes and ACR, but those data points “can be used for research and planning purposes, but not for transaction.”

Nielsen’s here-are-numbers-but-don’t-use-them approach has drawn significant criticism, particularly from the Video Advertising Bureau, a consortium representing the major network groups that has chafed under Nielsen’s monopoly for years. Tellingly, while numerous networks now offer data from rivals such as Comscore, VideoAmp, iSpot.tv and Samba TV as currency alternatives, none has yet signed on to do so with Nielsen One.

While Nielsen has the enormous advantages of incumbency and ownership of the dominant transactional media currency, its business is under threat in a way it hasn’t been in years, and maybe ever. Its measurement accreditation remains in suspension, numerous rivals (see above) have emerged and struck deals with major network groups, and the networks themselves have begun to attack Nielsen’s critical moat: a representative viewing panel. Nielsen One is the company’s attempt to future proof itself and maintain its historical dominance; if it is not a success, the measurement space will be truly up for grabs. | AdAge

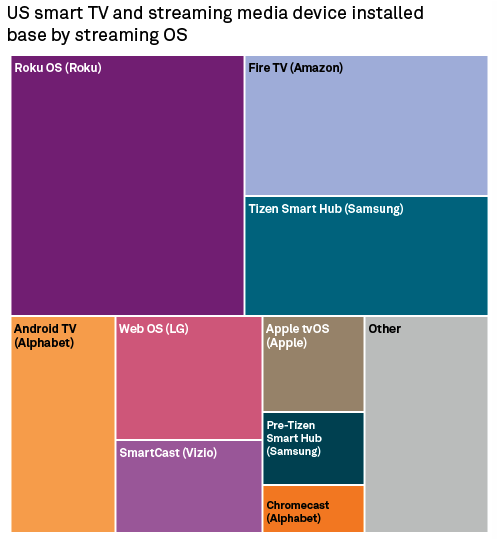

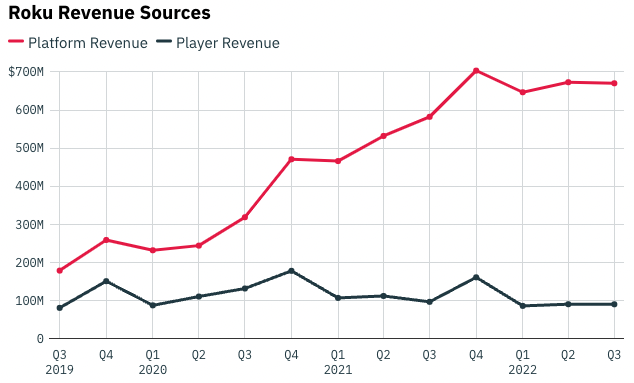

3. In last week’s 2022 Year In Review, we discussed the race between major tech companies and OEMs to dominate the smart TV space (“control the glass”) and inhabit the gatekeeper role in the streaming market. An important part of this story is the fall off of streaming sticks and media players, which are expected to grow at a much slower pace than smart TVs as consumers shun them in favor of integrated hardware/software offerings. This is important because the current leader of the TV streaming industry is Roku, the pioneer of streaming sticks.

For years, Roku has refused to create its own TV, instead partnering with OEMs like TCL and Hisense to bring its OS to market. But in an attempt to retain its position, Roku is taking a step to protect its market position by releasing a line of branded smart TVs in spring. Even though the hardware business is not a huge revenue generator for Roku, integrating into TV manufacturing may be a necessary move in order to expand the OS install base, where Roku accumulates the majority of its revenue via advertising and licensing.

The company also revealed this week that it reached 70 million active accounts globally, marking the second consecutive year that it has grown by 10 million accounts. By producing its own smart TV, Roku will be better positioned to keep pace with innovation and tech (like automatic content recognition) that is becoming essential in television advertising. | Digiday, Variety

Audio

1. Regular readers will know that the podcasting industry has exploded over the past few years. It’s projected to be the fastest growing advertising channel this year, ad sales are up to $1 billion annually, and the number of monthly listeners has increased to 38 million. Although this craze was primarily driven by creators and listeners, it was also propelled by large investments in content and advertising tech by audio streaming companies like Sirius XM and Spotify. While podcast listenership and ad spending are not obviously slowing down, industry experts feel as though business is, at least from an acquisition standpoint, beginning to plateau. According to Bloomberg, audio streaming providers have begun reducing their dealmaking, pulling back spend and distribution conversations with concern over broader macroeconomic conditions.

When publishers purchase shows upfront, they demand a larger share of advertising revenue – this might seem like a slowdown in the market to podcasters, but it more likely reflects a maturing ecosystem. Spotify now has 4.7 million podcasts on its site, up from 1 million four years ago – ergo, these platforms are much more saturated, and big spending on content might not be as necessary with increased volume for platforms and overwhelming choice for listeners. Moreover, these publishers spent aggressively to build out their podcasting departments, and are now looking to recoup their investment. There are still good reasons to believe that podcasting will have another great year in 2023: YouTube formally entered into the space just last year, international markets are still largely untapped, and technology is still evolving as advertising demand has yet to wane. Despite some criticism, podcasting will likely have another successful year, though change may be on the horizon (as we’ve seen within fast-growing streaming video publishers) as major players hurry to make back their investments in a slower advertising economy. | Bloomberg

Sports viewership picked up in a big way the week of December 12th, which was the week that gave us the World Cup semifinals and the epic final between Argentina and France. It seems Americans really are interested in soccer! (at least when it’s a World Cup) Notably, Spanish-language viewership, which surged earlier in the tournament, died back down in those final couple weeks – Mexico was eliminated at the group stage, which seems to have dampened interest among Spanish-speaking fans in the U.S.

Industry Notes

1. After months of negotiation, the NFL Sunday Ticket has landed with YouTube TV for a whopping $2 billion per year (estimated), bringing some of the most coveted programming in all of television to streaming TV. For roughly half-a-billion per year more than DirecTV was paying, YouTube is cementing its commitment to linear streaming and its unique position in the market as the most robust alternative to cable. Reportedly, Sunday Ticket will be available to fans as an add-on to YouTube TV, or as a standalone service in Primetime Channels, thus increasing accessibility to the product. YouTube’s seven-year gamble on sports streaming is the largest in the industry, but not altogether unprecedented – sports rights have increased at a very rapid clip in the past few years as streaming companies attempt to peel away audiences from linear TV. To YouTube’s credit, when Amazon Prime launched Thursday Night Football last year, it experienced the biggest day of sign-ups in its history. If YouTube can replicate that success, and capture audiences that might already be leaning towards streaming because of TNF, its position in the linear market will be hard to ignore. | WSJ

2. With Argentina’s epic victory over France in the final, the World Cup concluded with one of the most watched soccer games in American history. The exciting match averaged 22.32 million viewers across FOX and Telemundo, and garnered an additional 3 million across Telemundo’s streaming platform and Peacock. This ranked as the fifth-most watched soccer game in the United States, behind the final matches for both the 2010 and 2014 World Cups. The semi-finals also posted double-digit growth over corresponding matches in 2014 and 2018, setting a record for viewership on a single network. To note, this was the first year that Nielsen included out of home viewership, which likely inflated viewership numbers to some degree.

As was much discussed in the months leading up to the World Cup, there is a tangible appetite for soccer in the United States, perhaps more than ever before. For streamers like Apple TV+ and Peacock, the viewership success bodes well for their soccer rights deals in 2023. On the linear side, these results are encouraging for the 2026 Cup, which will be hosted jointly between the U.S., Canada, and Mexico. These numbers prove to be encouraging for a budding advertising opportunity for brands interested in tapping into soccer, while also sustaining interest, viewership, and ratings for live sports programming on linear and streaming alike. | SMW, SMW

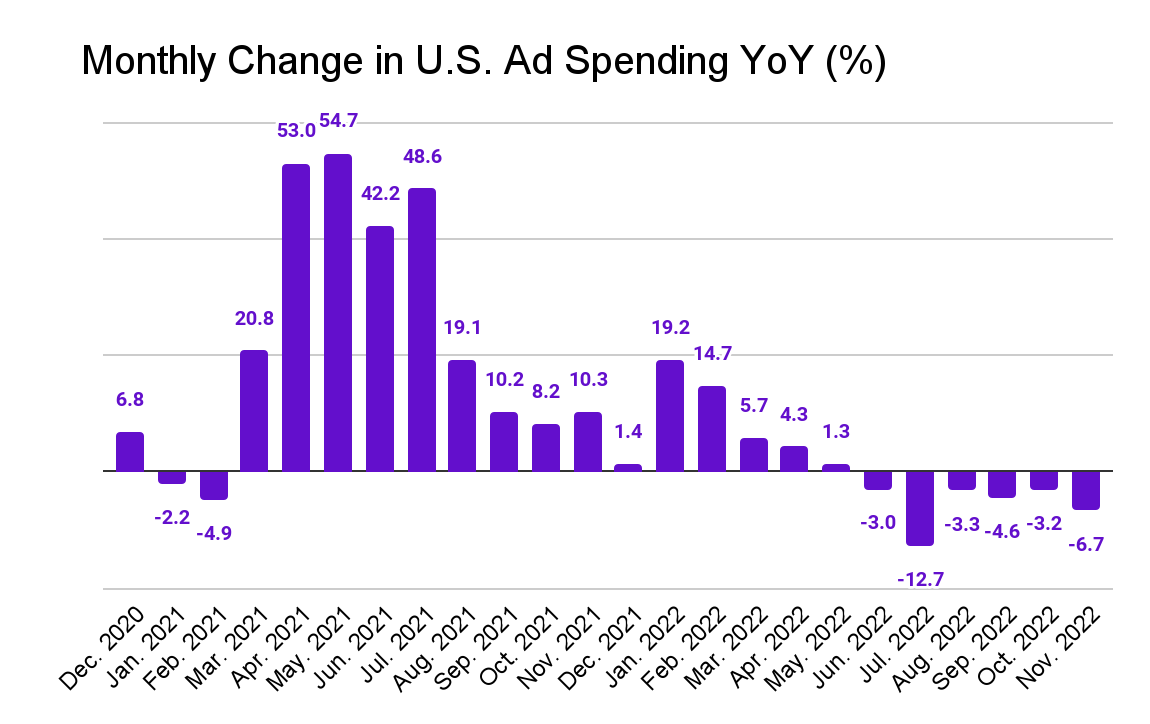

June of 2022 saw the U.S. ad market’s first YoY monthly decline in 16 months, as a roaring industry expansion during the pandemic ground to a halt. We are now in the retrenchment period, which we might even call an ‘advertising recession,’ as the U.S. ad market has contracted on a YoY basis for the sixth consecutive month, dropping 6.7% in November.

The robust growth early in the year means 2022 still turned in positive YoY growth, probably coming in around +2.4% – the past six months’ negative growth is stark, however, particularly in light of inflation having averaged over 8% during that time frame.

The month was noteworthy in an additional respect – for the first time since July 2020, digital ad spending declined in November, falling about 1% from the prior year. Over the June – October period, industry-wide contraction was driven by pullbacks in analog formats like linear television, print, and terrestrial radio, whereas digital formats maintained positive growth; the fact that this turned negative in November does not bode well for major platforms – like Snap, YouTube, and Meta – whose Q3 earnings results already demonstrated weakness in their core advertising businesses. | MediaPost, MediaPost

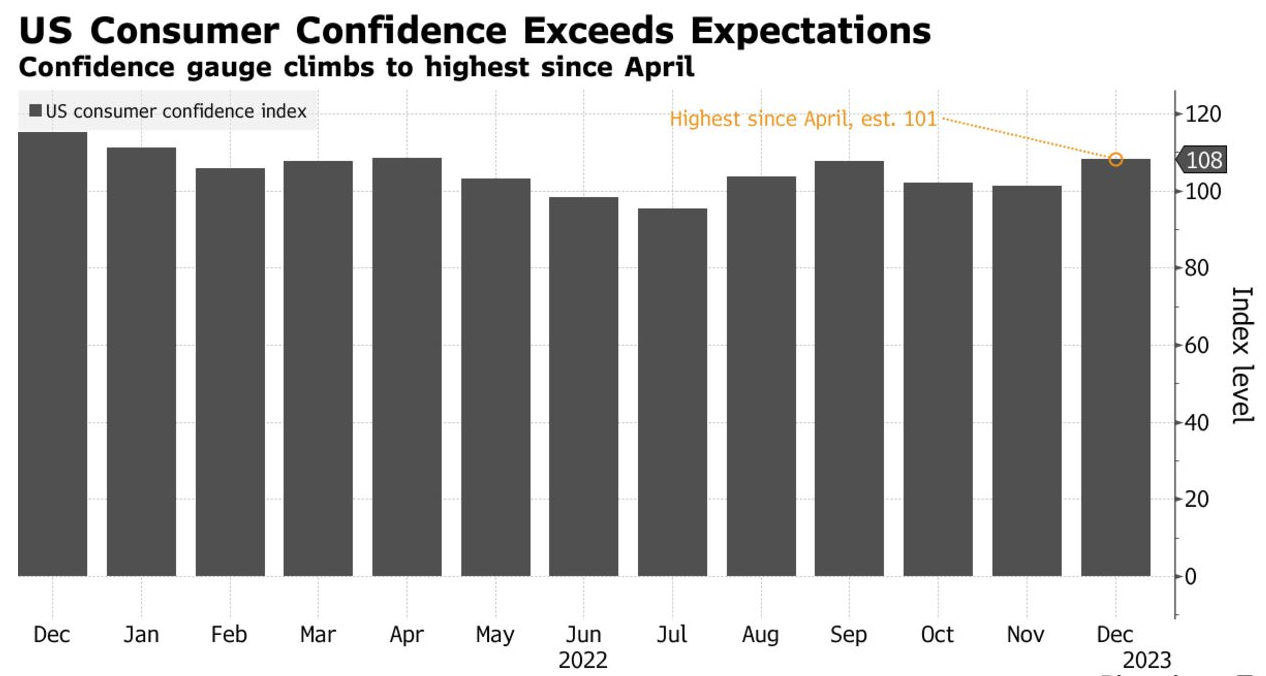

1. Despite signs of a looming recession, consumer confidence beat forecasts in December, rising to its highest level since April last year. With peak inflation and gas prices seemingly in the rearview, Americans’ expectation of inflation over the next year decreased to 5.9% and optimism about the labor market rose.

The positive outlook from consumers is contrasted with a slight pullback in consumer spending during the holiday season. According to Macy’s, the shopping holidays (Black Friday, Christmas) were themselves successful, but periods between those days saw larger than anticipated drop offs. Macy’s was joined by LuluLemon in lowering expectations for the fourth quarter and expressing concern that inflation would continue to weigh on profits in the new year. | Bloomberg

2. Way back in April last year we told you about Buy With Prime, a new offering from Amazon that would allow merchants to use the ecommerce goliath’s payments and fulfillment infrastructure outside of the Amazon platform. In addition to it being a major chess move in the ecommerce game, we flagged its importance as a potentially significant development in aiding merchants’ efforts to resist being subsumed within walled gardens (including Amazon’s!).

The program was invitation-only through the end of last year, presumably to allow for some beta testing; now, Amazon is opening up Buy With Prime to a wide array of merchants as of January 31st. Amazon has said the offering has helped merchants in its beta test boost conversion by an average of 25%.

This move has significant implications for the entire ecommerce industry, and most especially for companies like Shopify who are in the business of providing software (and, more recently, logistics) infrastructure to ecommerce merchants. We told you in September that Shopify seems existentially torn over whether to fiercely resist or to cooperate with Amazon; while it continues to assess, its rival BigCommerce announced an app that will let its customers easily integrate Buy With Prime into their online stores. While Amazon, Shopify, and others battle it out, ecommerce merchants and their customers would appear to come out ahead as a result of the intense competition. | The Information

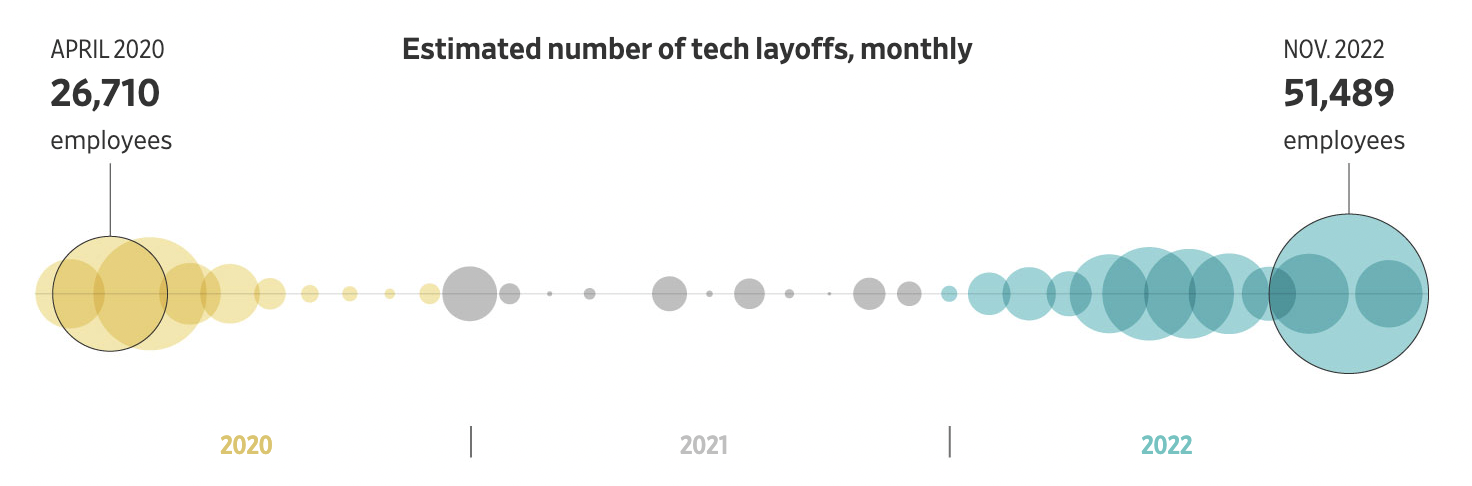

3. Tech layoffs are continuing into 2023, with Coinbase, Flexport, and Salesforce each eliminating 10-20% of their workforces. The narratives coming from the companies are familiar: aggressive hiring during the pandemic was necessary to meet increased demand, but consumer behavior and macro conditions post pandemic are straining revenues.

As we’ve discussed each time there is news of significant layoffs, the impacts on the tech industry have little relation thus far to the labor market at large, which remains strong. There are certainly signs that the labor market is cooling down – wage growth slowed recently – but with unemployment at 3.5% and 223,000 jobs added in December, signs are pointing towards a strong start in the new year. | WSJ, WSJ