Media Update: Social Commerce Movement, AI Advancements, Tariff Impact on Consumer Prices

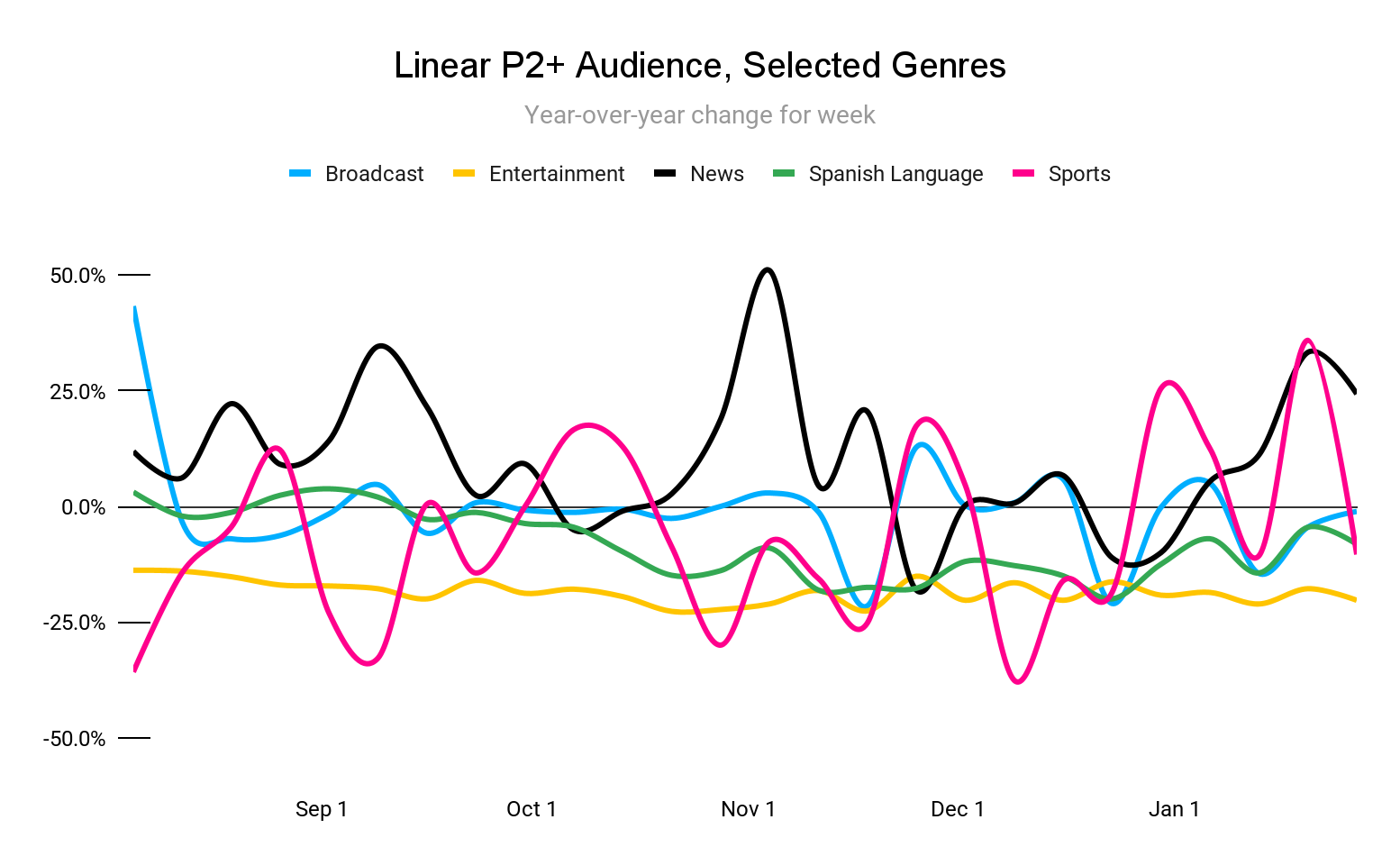

While entertainment audiences remained depressed year-over-year, other areas of linear have seen recent spikes. News and, to a lesser extent, broadcast viewership have seen some gains as coverage of the first two weeks of Donald Trump’s second term has dominated headlines. Sports viewership boomed in the week of the 20th, spurred by a record audience for the Bills – Chiefs AFC Championship.

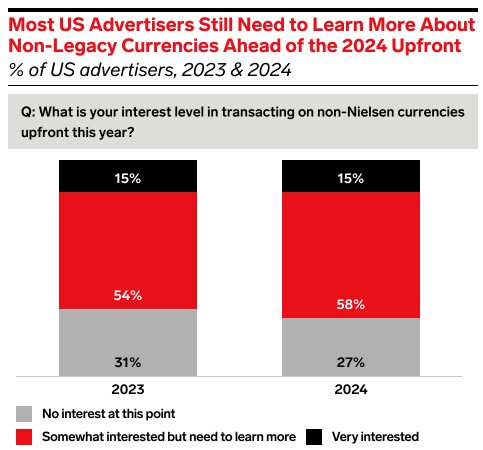

1. Frequent readers of this space (or even those with minimal experience in TV) will be very familiar with Nielsen. The measurement company has long been considered a gold-standard source of audience data – its data powers the chart above, and its Gauge has been a key resource for tracking the overall share gains of new and emerging streamers. Nielsen’s flagship offering has always been its panel data, which tracks the viewership behavior of over 40K households and has long been a primary currency of linear TV buying. However, in the face of competition from digital-native players like iSpot, Comscore, and VideoAmp, Nielsen is evolving its approach and leaning in on “big data”. Nielsen’s Big Data + Panel tool, which received approval from the Media Rating Council to be used as a buying currency, dramatically expands Nielsen’s data pool, incorporating information from 45 million households through set-top boxes and smart TVs. Soon after, Nielsen announced that it would deprecate its panel-only measurement by the end of 2025, solidifying its embrace of digitally-powered measurement.

The measurement giant clearly hopes that this shift will help preserve its advantage in the TV measurement space; while Nielsen remains the dominant player, a majority of advertisers are interested in exploring alternatives, and several major publishers have begun leveraging Nielsen’s competitors as alternative currencies. In fact, Nielsen had been in an extended standoff with Paramount over the past few months, with Paramount pushing back against the high prices Nielsen charged and leaning towards VideoAmp as an alternative partner. Shortly after Big Data + Panel was accredited by the MRC, Paramount and Nielsen renewed their agreement.

Overall, this development should help preserve Nielsen’s position, at least for the time being. For Tinuiti advertisers, expect trading to begin to shift towards the expanded data set as the year goes on. Nielsen expects this data to be more accurate, with figures 4-5% higher than panel-only counts, and more consistent with traditional Nielsen metrics than tracking from other competitors. In all, this should mean better, more consistent, more holistic measurement for the TV space. | eMarketer, AdAge

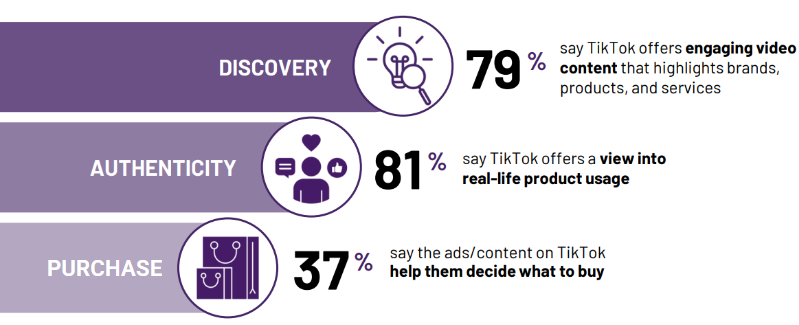

1. A new report from TikTok and IPSOS dropped this week, and it confirms what many advertisers have already been seeing—TikTok is more than just a discovery platform, it’s becoming a full-funnel commerce engine. The study found that 61% of TikTok users discover new brands on the platform, and nearly 50% have made a purchase directly from an ad or shoppable post. If you’re not already thinking about TikTok as a core sales driver, now is the time to rethink your strategy.

The report highlights TikTok’s unique ability to blend authenticity, community engagement, and personalized recommendations into a seamless shopping experience. With 73% of users saying TikTok provides better product recommendations than other platforms, the algorithm is doing the heavy lifting for advertisers. Even more compelling? 79% of users say they trust creator-led recommendations, making TikTok the go-to platform for turning brand awareness into actual conversions. Brands that embrace TikTok-native content formats—whether through creator collaborations, user-generated content, or interactive “shoppertainment” campaigns—are seeing 2.4x higher engagement than those running traditional ads.

The playbook for TikTok is continuing to shift: it’s no longer just about viral reach, but driving real business outcomes. In the wake of TikTok’s 14-hour shutdown, advertisers are moving beyond experimentation and are now focused on scaling. Brands that integrate TikTok shopping features including TikTok Shop, lean into creator partnerships, and craft engaging, commerce-driven content look likely to win in this new era. Social commerce isn’t on the horizon — it’s already here. | IPSOS

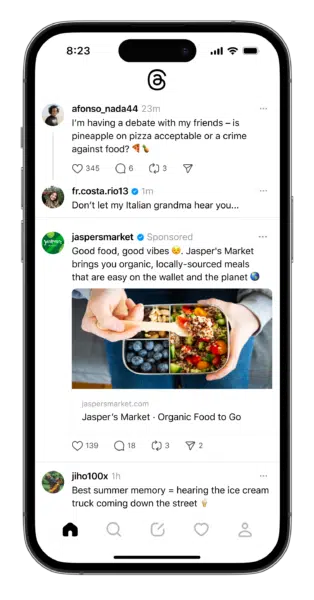

2. Meta’s Threads platform has reached a significant milestone, surpassing 300 million monthly active users. Not surprisingly, advertisers received welcome news in Meta’s announcement that it has initiated a test phase for ads on Threads. Currently, a select group of advertisers in the U.S. and Japan are participating in this trial, with image-based ads appearing in users’ home feeds. Meta plans to monitor user feedback and engagement closely before a broader rollout.

The introduction of ads on Threads offers a fresh avenue to engage a rapidly growing audience. Given that three out of four Threads users already follow at least one business, the platform presents a fertile ground for brand engagement. Advertisers can seamlessly extend their existing Meta campaigns to include Threads, ensuring consistent messaging across platforms. As Meta continues to refine the advertising experience on Threads, it is expected that more brands will slowly be getting access to ads on the platform over the coming months, although Meta has stated that it plans to limit inventory so as to prioritize the user experience. | SocialMediaToday, Reuters, SocialMediaToday, Search Engine Land

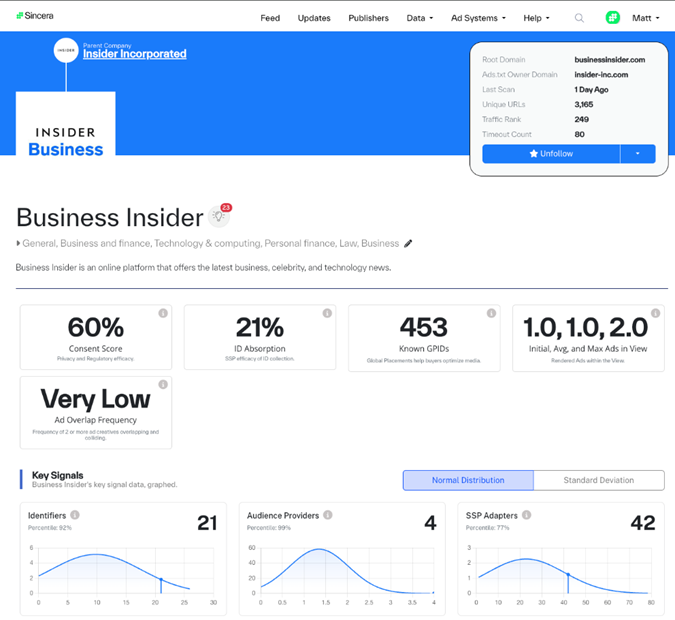

Mergers and acquisitions continue to make headlines, with The Trade Desk announcing a surprising yet strategic move to acquire Sincera, a leader in ad tech metadata. Known for building rather than buying, The Trade Desk’s decision reinforces its commitment to cleaning up the programmatic supply chain.

Sincera’s advanced web crawler analyzes how publishers implement and utilize advertising technology, offering insights into details such as ad configurations, privacy practices, and the use of universal identifiers like UID2.0.

As an initial investor in Sincera, the two have been collaborating for a few years. In fact, Sincera’s data played a key role in developing The Trade Desk’s SP500+ list last year, highlighting top-tier publishers based on ad transparency and quality. The two also partnered on made-for-advertising (MFA) detection, identifying publishers using subdomains with low-quality content to generate programmatic revenue from third-party traffic.

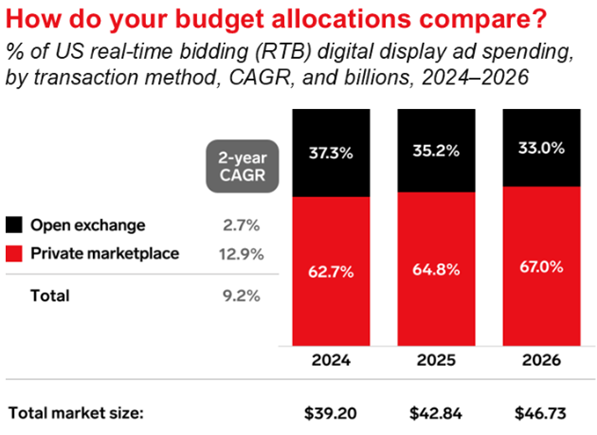

MFA sites are one of digital advertising’s biggest problems, diluting ad effectiveness and wasting ad spend. In response, the industry is shifting from the open exchange to curated marketplaces and private deals. According to eMarketer, this trend is accelerating, with private marketplace deals now accounting for 67% of display ad spending.

For advertisers, this merger could bring much-needed transparency to programmatic buys. While integration details are still emerging, advertisers will benefit from deeper insights into their media buys—examining ad environments, ad load, and refresh rates—allowing for more informed bidding and placement decisions. | The Trade Desk, The Trade Desk, AdExchanger, EMARKETER

Continued advancements in AI reasoning models are upleveling search results. Last week, both ChatGPT and Perplexity announced their technology is now powered by new advanced reasoning models (OpenAI o3-mini on ChatGPT, and DeepSeek R1 on Perplexity).

Perplexity, in particular, is taking an interesting approach that blends privacy safeguards with less censorship, layering in a tweaked version of DeepSeek R1. Perplexity’s open sourced model is hosted on secure servers based in the US and Europe, meaning that a Perplexity user’s data is not shared with the model provider or with China. This privacy-forward approach is likely very welcome news to AI enthusiasts who were spooked after a recent messy data leak from DeepSeek.

Graham Barlow, a senior editor focused on AI at Techradar, pitted ChatGPT’s 03-mini model vs. DeepSeek R1 to gauge how the results varied. “ChatGPT o3-mini is more concise in showing reasoning, and DeepSeek-R1 is more sprawling and verbose. If you really need to see the way the LLM arrived at the answer, then DeepSeek-R1’s approach feels like you’re getting the full reasoning service, while ChatGPT 03-mini feels like an overview in comparison,” according to Barlow.

The question remains: how will user behavior and expectations of search results continue to evolve as these developments continue? | OpenAI, Perplexity, Wiz Research, Techradar

For years, SEO has been a cornerstone of digital marketing, helping brands and publishers drive organic traffic through search rankings. Yet, claims that “SEO is dead” have persisted almost as long as the practice itself. While organic and paid search have historically been viewed as separate domains—akin to church and state—the search ecosystem is now experiencing tectonic shifts, and the line between these disciplines is becoming blurrier by the day.

The familiar refrain of “SEO is dead” echoes once again, but this time, there may be some truth to it. Or, perhaps, SEO isn’t dying—it’s evolving into something we don’t recognize. As AI-powered search advances, traditional SEO strategies are being upended, forcing marketers to rethink how they approach visibility in an AI-driven world.

The AI Search Disruption

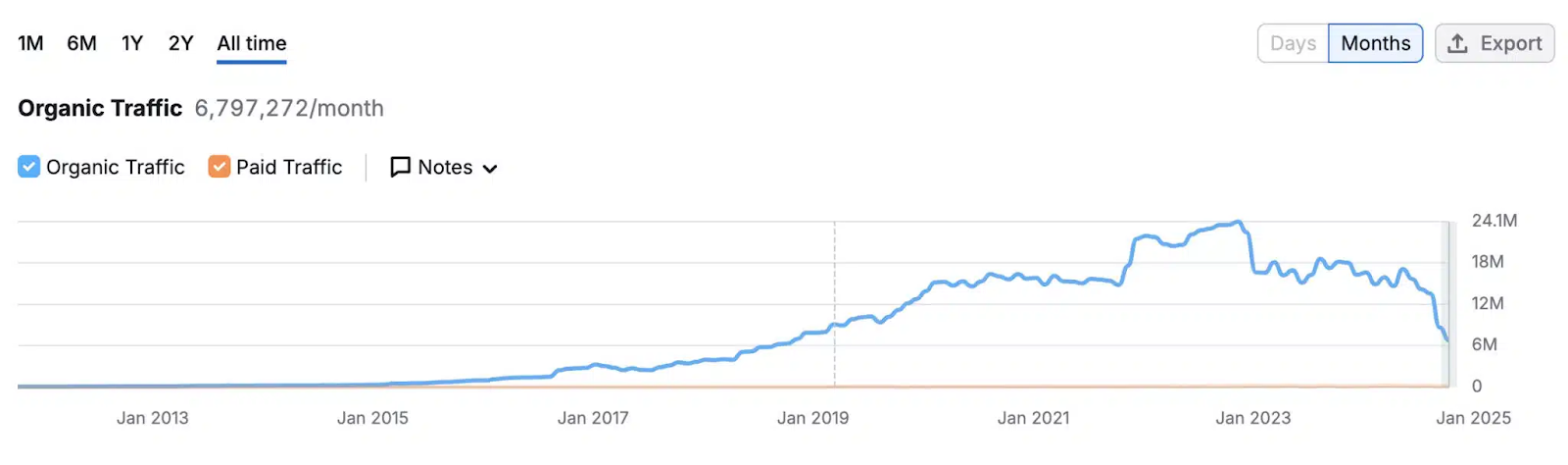

Google’s recent AI Overviews update exemplifies how AI is reshaping search behavior. AI-generated summaries now surface answers directly in search results, reducing the need for users to click through to websites. This shift has led to significant traffic declines for publishers that historically relied on Google.

For instance, HubSpot reported a 50% drop in organic traffic year over year, despite following best SEO practices. AI-driven search results prioritize direct answers over traditional rankings, forcing marketers to reconsider their content strategies.

The Fragmentation of Search Behavior

It’s not just AI Overviews altering SEO—consumer search habits are becoming increasingly fragmented. Users now turn to TikTok, Reddit, Amazon, and even ChatGPT instead of Google for product recommendations and information. This diversification means businesses must look beyond Google’s algorithms and optimize content for multiple discovery platforms.

Advertisers are also adjusting. As organic search traffic declines, brands are reallocating budgets to paid search, influencer marketing, and social search to maintain visibility and engagement.

Google’s Response: The New SEO Playbook

Despite these shifts, Google insists SEO is evolving, not disappearing. The company advises marketers to optimize for AI Overviews by focusing on structured data, concise direct answers, and conversational content. This aligns with the broader trend of AI-driven content discovery, where search engines prioritize authoritative, succinct responses over traditional keyword-stuffed web pages.

Some SEO experts predict that traditional keyword-based strategies will lose effectiveness as AI search refines its ability to provide instant responses. This evolution places greater emphasis on brand authority, direct engagement, and diversified traffic sources rather than solely relying on Google rankings.While SEO isn’t dead, it is becoming something unrecognizable – and the only bridge for many will be to focus investment on advertising channels. In the era of AI search, the winners will be those who embrace a holistic approach to content and discovery, moving beyond traditional tactics to meet users where they are. | Digiday, Search Engine Land, Search Engine Land, Search Engine Journal

1. The big news this week is, of course, tariffs – the Trump Administration on Tuesday implemented, via executive order, 10% across-the-board import duties on all goods from China, inclusive of heretofore exempt de minimis shipments under $800 in value. At the same time, the White House announced 25% tariffs on Canadian and Mexican imports, though imposition of duties has been paused for 30 days in each case. As of this writing, prediction markets are forecasting a 42% chance that tariffs on Mexican goods will come into force by May 1st, and a 37% chance for the Canadian duties.

The first-order effect of the tariffs will be to reduce consumer welfare – the Yale Budget Lab estimates the average US household will lose ~$1,250 of purchasing power as a result of higher consumer prices. The product categories that are expected to see the largest price increases are computer, electronic and optical equipment; leather products; electrical equipment; motor vehicles and parts; and wearing apparel.

We can also expect significant effects on the world of ecommerce. First, as noted above, the new tariffs end the de minimis exemption that allows duty-free importation of parcels whose value is less than $800. This poses a major disruption to the business model of direct-from-China sellers, such as Shein and Temu, which have used the de minimis exemption extensively and succeeded largely on the basis of ultra-low prices. Beyond behemoths like Shein and Temu, countless smaller businesses are facing the same headache; the director of a bra brand said, “Our tariffs went from 0% to 52% overnight.” Second is the massive logistical disruption this poses; apart from paying import duties, the paperwork associated with documentation of zillions of small-package shipments is a daunting challenge. We also saw reports of USPS suspending inbound parcels from China and Hong Kong, though shipments now appear to have resumed. Third, the aforementioned Shein and Temu are some of the largest digital advertisers in the US; Temu was Meta’s top advertiser in 2023, and one of Google’s top five, while Shein has also spent very heavily on these platforms. To the extent the new regulations impair their businesses in the US, one would expect reductions in Meta and Google ad investment from the major direct-from-China sellers, and hence slight reductions in equilibrium CPMs in those auction markets.

Finally, we have to consider retaliatory tariffs – the Chinese government has implemented new duties on a wide range of American imports, and has announced a new investigation of Apple’s App Store policies in the country (sound familiar?).

The tariff situation is highly fluid, and seems liable to change at a moment’s notice. We will of course keep you fully up to speed as the situation evolves. | White House Fact Sheet, Yale Budget Lab, The Information, WSJ

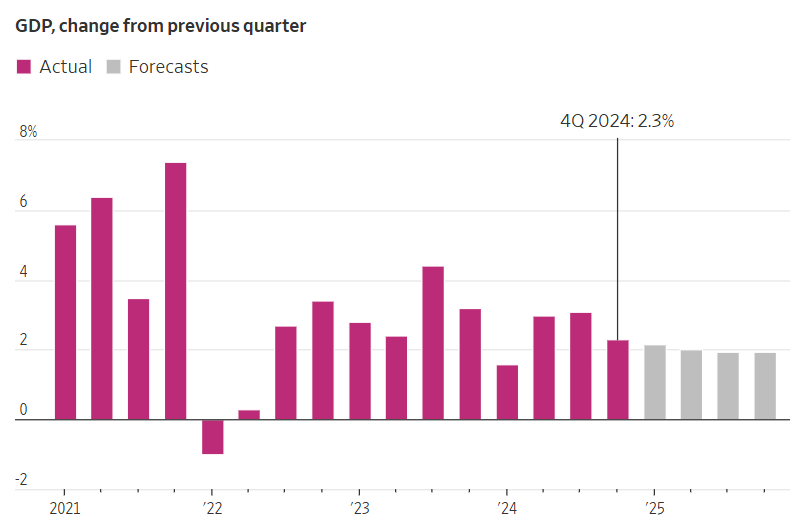

2. Outside of the tariff panic, the rest of the macroeconomy is doing … so so. U.S. GDP grew by 2.5% in 2024, with growth slowing somewhat in Q4 to 2.3%. This is a decline from 3.2% growth in 2023, but it’s a pretty average rate of growth for the modern US economy; we used to grow faster, but a productivity slowdown set in in the 1970s and we just don’t grow as fast anymore.

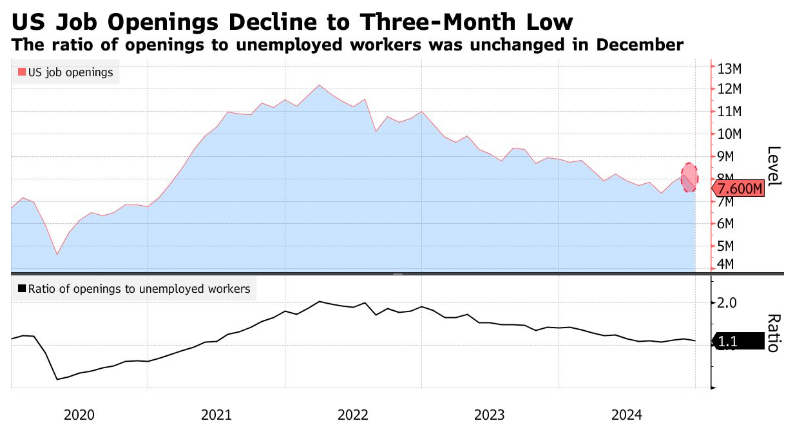

The labor market, which has demonstrated exceptional resilience since the pandemic, is showing some wobbly signs: US job openings fell in December by more than forecast to a three-month low. Openings have been on a pretty steady decline since peaking in early 2022, when the post-pandemic economy was reopening and demand for labor was insatiable.

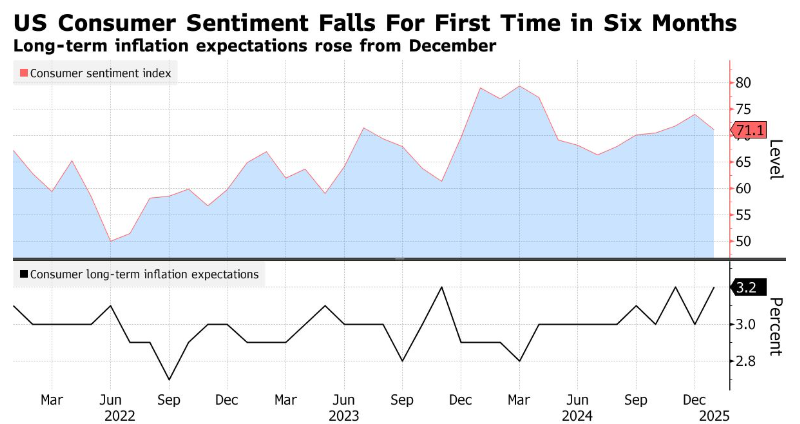

The confluence of these and other factors led to a decline in consumer sentiment in January for the first time in six months, on concerns about unemployment and the impact of potential tariffs on inflation.

According to the survey, consumers expect prices will climb at an annual rate of 3.2% over the next five to ten years, up from the 3% expected in December. | WSJ, Bloomberg, Bloomberg