Cyber Five 2023: Black Friday and Cyber Monday Ad Trends Across Google, Amazon and Meta

The leftovers have been devoured and another Cyber Monday is in the books, as the 2023 holiday shopping season is now fully underway. To help marketers unpack performance during the critical stretch from Thanksgiving through Cyber Monday, we dove deep into the more than $4 billion in annual ad spend under management at Tinuiti to surface key trends on the biggest digital marketing platforms.

The charts and paragraphs below highlight some of the key insights we uncovered.

This post was coauthored by Andy Taylor and Mark Ballard.

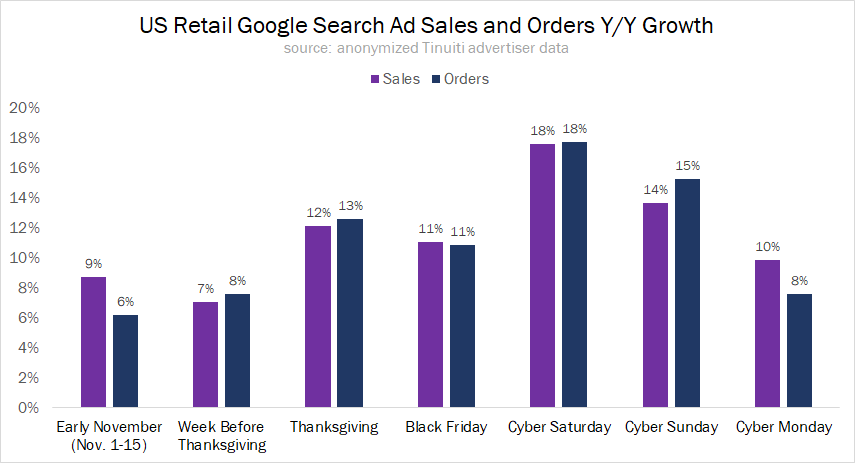

Over the Cyber Five period covering the five days from Thanksgiving Day through Cyber Monday, growth in retailer sales produced by Google search ads was strongest over the weekend before cooling off a bit on Monday.

Google search sales were up 9% year over year over the first half of November 2023 and 7% during the seven days before Thanksgiving. On Thanksgiving itself, sales growth jumped to 12% on a 13% increase in order volume. Sales growth dipped to 11% year over year on Black Friday, before jumping to 18% on Saturday and 14% on Sunday.

A year earlier, Black Friday and Cyber Monday saw the strongest sales growth rates over Cyber Week, leading to particularly strong comps this year. Consumers may also be more inclined to spread their purchases out over this period given that many brands offer their strongest promotions over the entire Cyber Five, if not beyond.

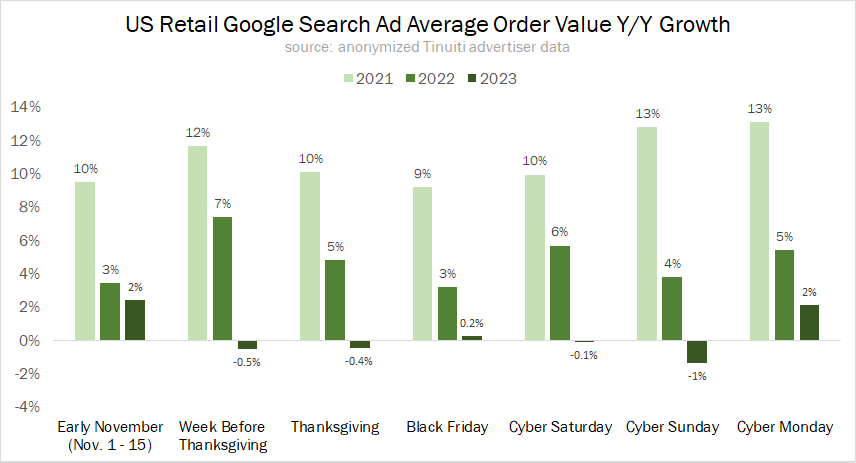

After growing by double digits over Cyber Week in 2021, the average value of an order produced by Google search ads grew at about half those rates a year later. In 2023, average order value was down more days than it increased, although it was roughly flat over the entire Cyber Five.

In recent years, Google average order value (AOV) growth peaked in May 2021 and has since been decelerating. Over the first three quarters of 2023, Google search ad AOV growth averaged just 1% Y/Y as official measures of inflation rates have also come down.

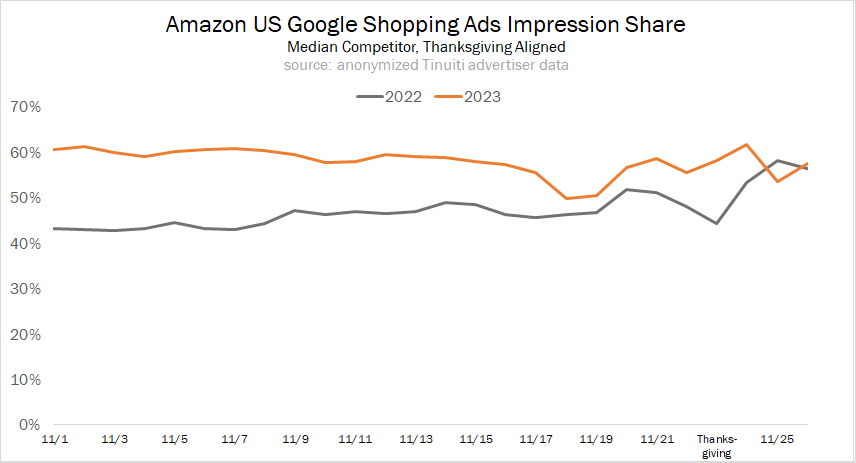

For most of 2023, including the November runup to Cyber Week, Amazon’s share of Google Shopping ad impressions has run quite a bit higher than a year earlier. For the first half of November, Amazon’s typical impression share was 60% in 2023, compared to 45% in 2022.

But while Amazon saw a sharp jump in its share of impressions from Thanksgiving through Black Friday in 2022, its share of impressions held steadier in 2023. Ultimately, Amazon’s presence in Google Shopping auctions is now about on par with 2022 and it may be pretty close to an upper bound, even for the brand that is most retailers’ biggest competitor for Shopping impressions.

From the World Series to Black Friday, sync important dates to your calendar with one click.

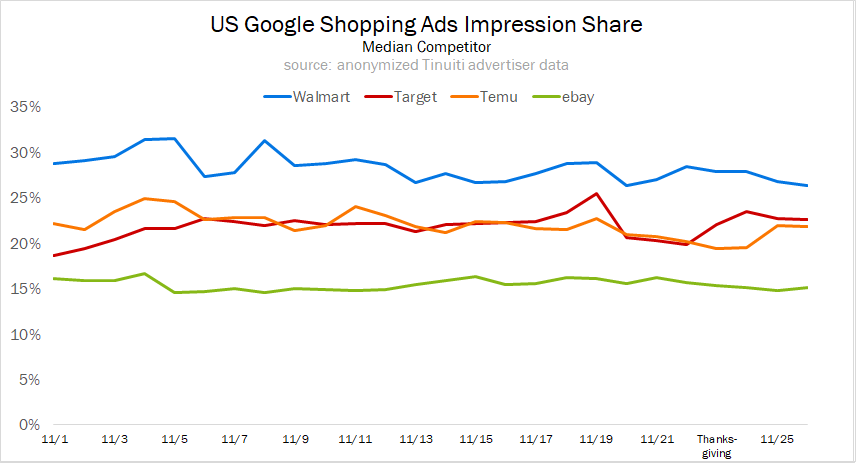

After Amazon, three of the biggest competitors for Google Shopping impressions have long been Walmart, Target, and eBay. These stalwarts in Google’s ad listings have now been joined by Temu, who barely registered in Google Shopping auctions until the very end of the 2022 holiday season.

As with Amazon, there wasn’t much change in the impression share numbers for these four advertisers from early November into the Cyber Five, but just the addition of a new competitor at the scale Temu is participating in Google auctions is a significant development for this holiday season compared to the last.

Amazon extended its Black Friday and Cyber Monday shopping event to eleven days this year, getting in front of consumers with promotional offers in advance of Thanksgiving. The strategy paid off, with sales attributed to Sponsored Products rising 16% year over year in the week before Thanksgiving, four times the growth observed last year during the same time frame. Sales growth also accelerated significantly on Thanksgiving Day, going from 8% growth in 2022 to 29% in 2023.

Black Friday showed the strongest growth in sales attributed to Sponsored Products with a 38% increase. Sales growth slowed throughout the rest of the Cyber Five, but still remained above 10% through Cyber Monday. This was a reversal of 2022, when sales growth steadily grew stronger throughout the Cyber Five.

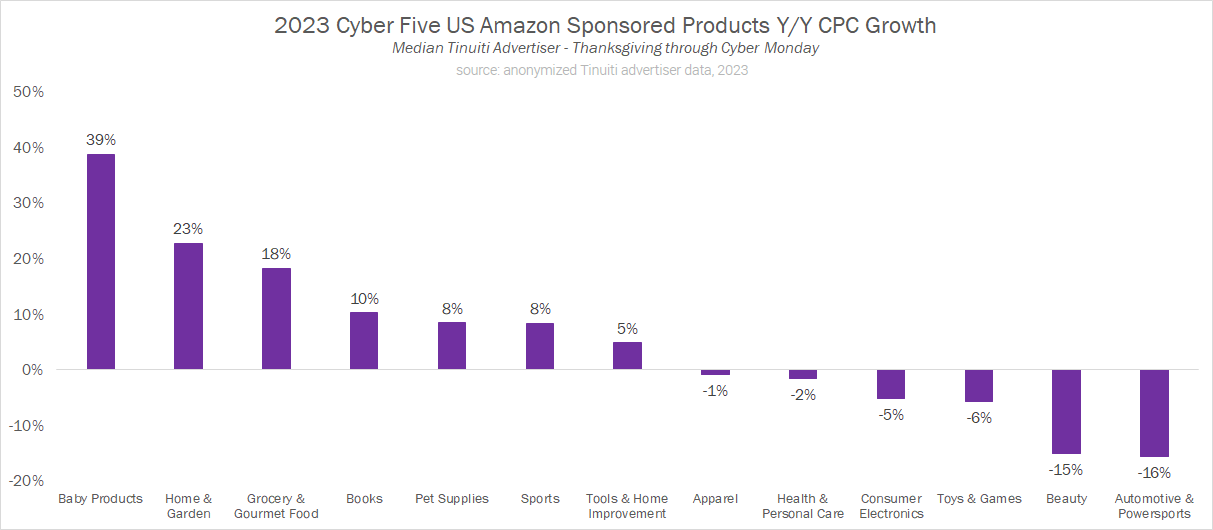

Sponsored Products CPC growth was markedly different from category to category, with baby products seeing the strongest growth at 39% and automotive/motorsport products seeing the biggest decline with a 16% drop.

During last year’s Cyber Five, most product categories saw CPC declines year over year, and CPC growth has been steadily accelerating throughout 2023 for most Sponsored Products advertisers.

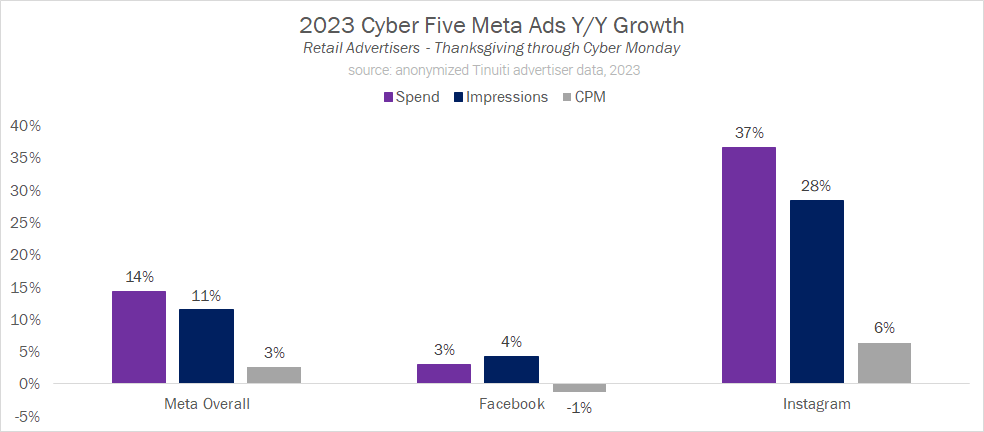

Retail advertisers ramped up investment across all Meta properties by 14% year over year, with an 11% increase in impressions and 3% rise in CPM. The growth was driven predominantly by Instagram, where spend rose 37% year over year.

In 2022, Meta CPM declined a whopping 29% compared to the Cyber Five of 2021, but pricing has now stabilized for many advertisers. Facebook CPM dipped just 1% over the Cyber Five in 2023, while Instagram CPM rose 6%.

Instagram impression growth soared from 4% Y/Y during last year’s Cyber Five to 28% in 2023, helped along by new inventory sources like Reels.

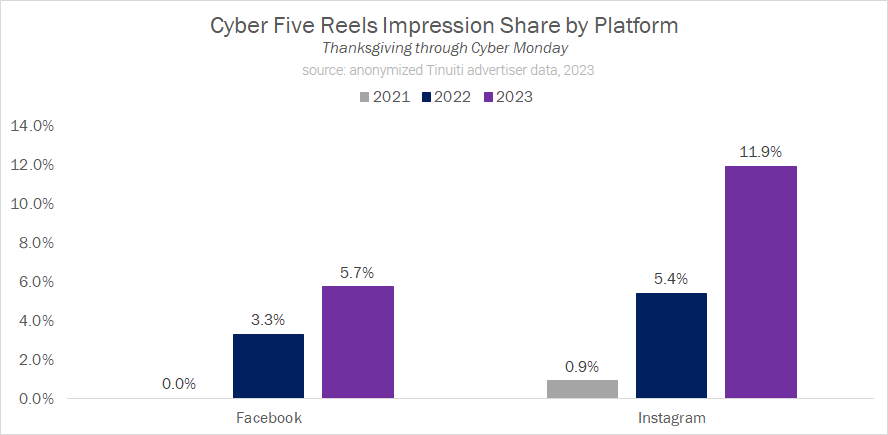

Reels video ads have been steadily climbing in importance across Meta platforms, and during the 2023 Cyber Five accounted for 11.9% of Instagram ad impressions and 5.7% of Facebook ad impressions. This represents significant growth for both platforms, as Reels video units accounted for just 5.4% of Instagram impressions and 3.3% of Facebook impressions during the Cyber Five in 2022.

With these placements as well as other newer inventory like Instagram Explore Grid Home ads steadily gaining traction, impression growth has been the driving force for increases in spend throughout 2023.

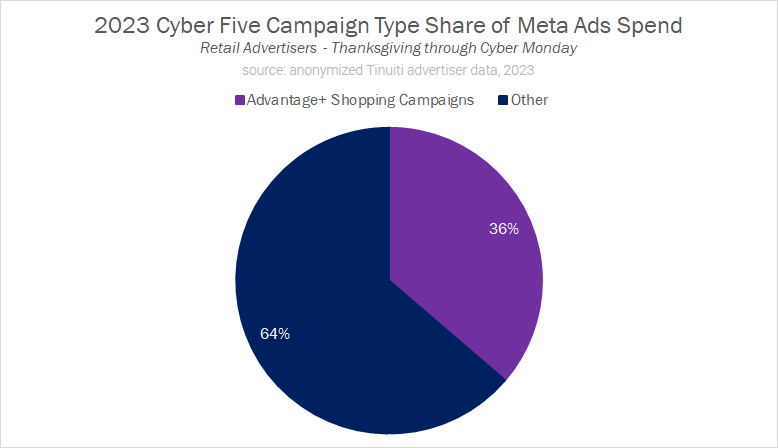

In addition to new inventory sources, newer campaign types are also helping advertisers to increase spend on Meta properties.

Since their inception in 2022, Advantage+ shopping campaigns (ASC) have quickly risen to become an important part of advertising strategy for many retailers on Meta. During the Cyber Five, ASC accounted for 36% of all retail advertiser spend across Meta platforms.

Much like Performance Max campaigns on Google, ASC uses AI-powered technology to simplify campaign setup and management for Meta advertisers. Advertisers do lose some control in handing the keys over to campaign types like Performance Max and ASC, but many brands are finding them useful as part of a well-rounded advertising strategy.